Takeaways from the Munich Security Conference

Plus easing natural gas prices in Europe, challenges in the cobalt industry, and a Special IEA Ministerial

(Source: MSC)

Munich Security Conference - Early Takeaways

The annual Munich Security Conference, which wrapped up yesterday, brought together security and diplomatic officials from around the world. While more information about the conference will likely emerge this week, some notable points below:

TRANSITIONING MILITARIES: A side event titled Cleaner and Meaner: The Military Energy Transition by Design was co-hosted by NATO and the International Military Council on Climate and Security (IMCCS) to discuss the military alliance’s transition to clean energy “while ensuring military effectiveness in a deteriorating security environment”. The organization has been more active in recent years in incorporating climate change-related security impacts and energy transition within the context of its mandate (for more, see NATO’s 2021 Climate Change and Security Action Plan).

According to NATO Assistant Secretary General for Emerging Security Challenges, David van Weel, the alliance needs, “to mainstream climate change and energy transition considerations into the entire NATO enterprise, including training, exercising, force planning, and the development and procurement of military capabilities.”

In the lead up to the event, Climate and Security noted that one important factor for NATO is identifying and mitigating new dependencies that emerge from the switch away from Russian fossil fuels and toward the critical mineral supply chains dominated by China.

TAKEAWAYS: NPR listed four key (non-energy and climate related) takeaways from early observations of the conference:

First, the U.S. escalated its accusations of Russian “war crimes” to “crimes against humanity”, citing the findings of a recent Conflict Observatory and State Department investigation which highlighted the “unlawful transfer and deportation” of citizens, including children.

Second, China views peace in Ukraine as a top priority and warns against a return to “Cold War mentality”, while also cautioning against any interference in its dealing with Taiwan. However, following a meeting between U.S. Secretary of State Antony Blinken and top Chinese diplomat Yang Yi, Blinken today said that China may start providing “lethal aid” to Russia (BBC); an accusation that China strongly denies.

Third, European leaders are committing to investing more in weapons, with European Commission President Ursula von der Leyen urging states to work collectively with the defense industry to scale up production of munitions for Ukraine.

And finally, Russian and Iranian officials were notably not invited to the conference, the first time since the 1990s (Russian officials were invited to last year’s conference but chose not to attend).

REPORT: Ahead of the security conference, the annual Munich Security Report was published. Chapter 5 Energy Security: Refueled includes a review of last year’s energy upheaval and the implications for security moving forward.

Setting the context, the report states that “energy ties between Russia and Europe will be permanently severed”, issuing in a great reshuffling of global fossil fuel trade flows that are to be focused more on “geopolitical fault lines than market logic” as countries work to reduce their exposure to unfriendly regimes.

This dynamic is evident as Russia is working to reroute its oil and gas exports to the Chinese market[1], and as Europe has looked more to the U.S. to provide critically needed LNG over the last year.

The split, however, is not simply a neat divide between democracies and autocracies: Middle East states will continue to supply both Europe and Asia, and Australia and the US will likely remain key suppliers to China.

Concerns remain about the potential of social unrest, growing animosity between EU member states, and eroding support for Ukraine.

Europe is still struggling to find a cooperative approach to the energy crisis and its response to Russia, as evident in the extended and difficult negotiations over the Russia gas price cap last year.

“As the world weans itself off fossil fuels, green energy is gaining in strategic importance” the authors write. At the same time, they explore the tension created by the growing use of industrial policy: “localizing supply chains might help reduce dependencies, but trade has been essential in bringing down costs of renewables and preserving flexibility in energy markets.”

Finally, the report also notes the ripple effects on food insecurity and extreme poverty that the conflict is having on low-income countries, particularly in sub-Saharan Africa.

Europe is out bidding almost all other buyers on the LNG spot market, leading to shortages and widespread blackouts in places like Pakistan and Bangladesh.

As the “scramble for fuel” continues, it risks worsening the tension between Europe and emerging/developing countries, and weakening the global response to Russia’s aggression.

Natural Gas Prices Are Down In Europe

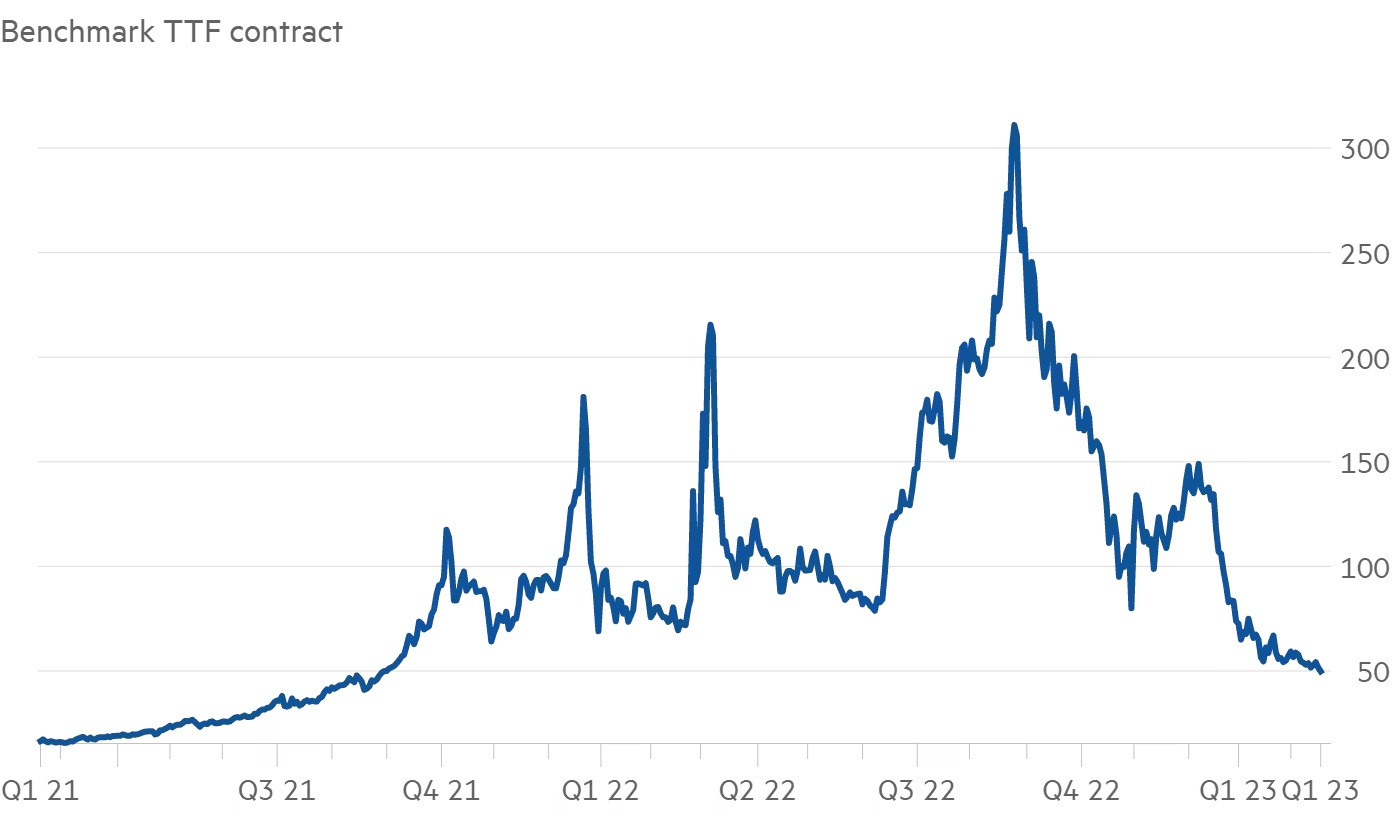

DRIVING THE NEWS: Natural gas prices settled at an 18-month low on Friday, trading at €48.90/MWh (down from over €300/MWh in August 2022) (Financial Times).

Figure 1: European gas prices falling 85% from August 2022 to today (Source: Financial Times and Refinitiv)

WHY IT MATTERS: Although still roughly double the five-year average price at this time of year (Bloomberg), the declining cost of natural gas and higher-then-expected storage levels due to a mild winter means there is growing confidence that Europe will avoid dramatic energy shortages and experience only a mild recession or none at all.

Prices have fallen into the “fuel switching range”, where it is now more profitable to use high efficiency gas generators than low efficiency coal plants. This is a key step toward returning to a “normal” energy mix in Europe.

“The reality is that winter 2023-2024 is likely to be the real test” said Fatih Birol, IEA Executive Director. Yet gas storage across the continent currently sits at 65%, which bodes well for refilling ahead of next winter (NY Times).

Figure 2: A compelling graphic from Bloomberg visualizing an energy crisis index across major European countries and a number of energy metrics

THE IMPACT: Declining natural gas prices are a major hit to Russia’s revenue stream, especially when combined with the deep discount put on Russian oil over the last two months. High energy prices have been a major funding source for Russia’s military since the invasion, meaning extended low prices could put serious pressure on the Kremlin’s ability to finance the war.

ZOOMING OUT: While the lower prices are good for Europe, they may also begin to drive more demand in Asia–particularly China. This poses the biggest risk for Europe’s gas supply, as so far high prices and zero-COVID policies have kept purchasing competition relatively low.

IN RELATED NEWS: The US LNG facility at Freeport is preparing to come back online. The facility provided 15-20% of US LNG export capacity before a June 2022 fire caused a shutdown.

The operator says that reconstruction work is substantially complete and they have filed a request with FERC to begin operating the facility at full capacity again (Journal of Petroleum Technology).

At full capacity the export terminal can process 2.1 billion cubic feet per day, which will provide a much-needed supply boost to the global natural gas market. On Feb 14 the facility received 700 million cubic feet per day, ramping up quickly from 430 million cubic feet the day before.

Cobalt Demand Falls

DRIVING THE NEWS: Cobalt prices have fallen substantially in the last year, from $82,000 per tonne in Spring 2022 to just $35,000 per tonne today (The Economist).

WHY IT MATTERS: Cobalt-a critical component in lithium ion batteries and other technologies–was long seen as a potential choke point in the energy transition and a risk given that the main supplier is the politically and socially unstable Democratic Republic of the Congo (the cobalt mining industry in DRC is also notorious for human rights violations).

However, the falling prices and falling demand is evidence of the major lengths companies are going to move away from dependence on the metal, and may suggest that cobalt will not play the critical role in the energy transition that many thought it would.

The price is now dropping below many miner’s break-even points. While in many industries this would worryingly result in production cuts, one of the largest sources of cobalt is in fact as a byproduct of copper and nickel extraction; both of which are trading at high prices. As a result major cobalt suppliers like Glencore and China Moly are not signaling an production cuts in the near future.

DRIVING FACTORS: The price reduction is due to a combination of reduced demand and quickly increasing supply.

Demand for consumer electronics, particularly in China, which had boomed during the pandemic has come down now that lockdowns and quarantines are no longer forcing people to stay inside.

Demand for EV manufacturing has also gone down as EV companies worried about supply have taking major steps to reduce cobalt use. “The distinction between cobalt and lithium is that carmakers are very eager to get hold of lithium, while they’re doing everything they can to get rid of cobalt,” explained Michael Widmer, head of metals research at Bank of America Corp. (Bloomberg)

At the same time, production in Congo is forecasted to rise 38% this year up to 180,000 tonnes and Indonesian exports have increased to 18,000 tonnes this year.

Special IEA Ministerial on Gas Markets and Supply Security

Last week the IEA held a virtual Special Ministerial in which 40 governments took part, including all 31 IEA member countries as well as ministers from Bulgaria, Croatia, Latvia, Moldova, Romania, Slovenia, Ukraine, and the EU (IEA).

The event was chaired by Canada’s Jonathan Wilkinson, Minister for Natural Resources, and co-chaired by the US Secretary of Energy Jennifer Granholm and Ireland’s Eamon Ryan, Minister of Environment and Climate.

BACKGROUND REPORT: Ahead of the meeting the IEA published their Background note on the natural gas supply-demand balance of the European Union in 2023, which noted that the supply-demand gap facing the EU in 2023 has fortunately narrowed. It recommends four key policy actions:

First, to reduce natural gas in a structural manner, noting the potential for a 37 bcm reduction in 2023 through improved energy efficiency, continued expansion of renewables, deployment of heat pumps, and behavioral changes.

Second, to continue optimizing the future of existing infrastructure and to advance remaining gas infrastructure priority projects.

Third, to enhance solidarity with the “eastern neighborhood of the European Union” including Ukraine, Moldova, and other resource-limited countries.

And forth, to enhance market transparency and data exchange on energy supply security, including closer and more regulated dialog between responsible energy producer and consumers.

TAKEAWAY: The discussion focused on ways to limit the impacts from the global energy crisis, including support measure for affected countries.

Secretary Granholm warned: “the manipulation by malign actors will persist beyond this winter, and we cannot simply hope for the relief of more mild seasons. We have a window of opportunity to prepare options for coordinated response, using the best analysis we can muster, and we are committed to making use of it.”

The countries agreed that the IEA should build upon its successful 10-point plans released last year (natural gas and oil) to now provide updated roadmaps on how to implement the recommendations set forth in the background report.

DIVE DEEPER: The official Ministerial Statement includes details of the discussion.

[1] The report predicts that Russia will not be able to shift all of its supply to Asia, and projects that by 2030 Russia’s share of global O&G trade will be cut in half. It also notes that Russia’s hydrogen ambitions are faltering, adding to the downfall of Russia’s role as a future global energy provider.