DOE Explores Hosting AI Data Centers on Federal Lands

Plus the US-Ukraine mineral deal, how new requirements for US-built ships impact the LNG industry, the US moves to jumpstart deep sea mining, and a new perspective on the future energy economy

This week we look at the growing challenges around AI data center expansion and a plan by the DOE to open federal lands for development, details on the agreement finally reached between the US and Ukraine for critical minerals, the US LNG industry’s reaction to new requirements for US-built ships to carry exports, updates on the growing interest in deep sea mining, and a summary of a recent perspective published on The New Joule Order.

DOE seeks to open opportunities for data center co-location

What to Watch: With data center demand continuing to rise, the US Department of Energy is now exploring how to host the next wave of AI infrastructure directly on federal lands, opening new opportunities for developers.

Driving the News: Earlier this month, the DOE released a Request for Information focused on siting AI data centers at 16 DOE-owned sites, including Los Alamos, Oak Ridge, and the National Renewable Energy Laboratory. The agency is seeking input on power needs, co-location strategies, potential technology partners, and local engagement, with responses due May 7, 2025 (Energy.gov, Federal Register).

The DOE is framing the RFI as a precursor to a potential Request for Proposals, touting benefits including proximity to power infrastructure and interconnection, secure sites, and collaboration with federal research facilities.

Why It Matters: The growth of generative AI is colliding with constraints on the US energy system. While data centers make up just 1.5% of global electricity demand today, their demand has been growing four times faster than the rest of the grid (IEA) and is projected to more than double by 2030.

Companies like Amazon and Nvidia continue to push forward aggressively on AI data center expansion, arguing that the industry’s reaction to DDeepSeek was “kneejerk” and that energy demand growth will still be substantial (CNBC).

However, communities and local utilities are beginning to raise concerns about power constraints and competing demands, particularly in areas with limited energy resources. At a nuclear plant in Pennsylvania, Amazon’s co-located data center recently submitted an application to increase its power draw, potentially putting strain on other users in the region (Financial Times).

The Bigger Picture: In a recent op-ed, former Treasury Secretary Hank Paulson made the case for a national energy strategy to ensure the US remains competitive in the AI era (FT).

He argues that while renewables are the best near-term options given the supply constraints on gas turbines through the end of the decade, the country needs hybrid models (like solar plus storage or gas peakers) and a regulatory environment that prioritizes speed, flexibility, and cost-effectiveness.

The IEA View: A new report from the IEA emphasizes that “there is no AI without energy,” and that at the same time, AI is becoming increasingly central to energy security, especially in advanced economies.

In emerging and developing economies, the picture is more complex: those countries that can offer reliable, low-emissions electricity are likely to attract new data center investment (and the associated AI benefits), while those without it may have a harder time or see data centers competing with other, more basic energy needs.

Looking Ahead: The DOE’s new initiative could be a major step in aligning US industrial and energy strategy, but only if the supporting infrastructure is ready. The RFI responses will shape whether this becomes a viable federal pathway and are worth watching.

Follow Up: US and Ukraine sign minerals deal

Driving the News: On Wednesday, the United States and Ukraine signed a long-negotiated economic partnership deal that grants access to Ukraine’s critical minerals and other natural resources.

The deal, which was almost lost after a tense interaction between Presidents Trump and Zelenskyy at the White House in February (see previous post), comes as Trump is increasingly frustrated with Russia in the peace negotiation process.

The Messaging: In announcing the agreement, US Treasury Secretary Scott Bessent said it “signals clearly to Russia that the Trump Administration is committed to a peace process centered on a free, sovereign, and prosperous Ukraine over the long term.” Ukraine’s First Deputy Prime Minister Yulia Svyrydenko added, “Together with the United States, we are creating the Fund that will attract global investment into our country” (Financial Times).

Deal Structure: The agreement formally establishes the United States–Ukraine Reconstruction Investment Fund, which will direct capital toward the extraction of minerals, oil, and gas, along with related infrastructure and processing (US Treasury).

For the first 10 years, all profits will be reinvested into Ukraine. The fund will be jointly managed with equal ownership and will not include any retroactive compensation for the military aid provided by the US to date; both key concessions secured by Ukraine. In addition, Ukraine reserves the right to determine what natural resources are extracted.

For its part, the US avoided providing any security guarantees or specific military funding commitments, and has now established a mechanism to continue providing military aid in a way that the Trump administration can sell as ‘an investment’ back home.

The Response: Russia’s response was predictably angry, saying that the deal will make it harder to reach a peace agreement as the US now has a mechanism to justify new spending on the war.

Dmitry Medvedev, former president and current deputy chairman of Russia's Security Council, delivered a scathing rebuke, stating: “Trump has broken the Kyiv regime to the point where they will have to pay for U.S. aid with mineral resources” (Reuters).

While EU officials have not yet publicly weighed in, the fund’s structure and resource provisions could draw scrutiny in Brussels as Ukraine advances its membership bid.

The Geopolitics: Important to Ukraine was ensuring that the deal does not interfere with its goal to join the European Union, a move the country sees as critical to its long-term strategy for protecting its sovereignty. The agreement includes an option to revisit the text if adjustments are needed as part of joining the EU, with the US agreeing to negotiate in good faith.

New US vessel restrictions put pressure on LNG export industry

Driving the News: Last week, the US Trade Representative (USTR) announced its final action aimed at restricting the use of Chinese-flagged and Chinese-built ships in support of the US shipbuilding industry.

Ambassador Jamieson Greer, the current US Trade Representative, explained: “The Trump administration’s actions will begin to reverse Chinese dominance, address threats to the U.S. supply chain, and send a demand signal for U.S.-built ships.” The investigation, however, was initiated under the Biden administration following a petition from five major US unions (USTR).

Why it Matters: While a win for the US shipbuilding industry, the order puts pressure on other sectors, including the booming US LNG export industry.

While the immediate impacts will be limited given the 180-day grace period and phase-in approach (with initial requirements starting in 2028), the industry has warned that it cannot comply within the time allotted and that the order could damage the $34 billion LNG export industry (Financial Times).

Industry groups including the American Petroleum Institute (API) have sent letters to the administration requesting exemptions for LNG and other energy-related exports.

As Charlie Riedl, Executive Director of the Center for LNG, explains: “The proposed maritime restrictions—particularly the requirement to transport US LNG on US-built and flagged vessels—are simply not feasible… There are no such vessels in existence today, and building them would take decades, making compliance impossible for the industry” (S&P Global).

The Context: Chinese-built LNG tankers make up roughly 7% of the global operating fleet, but 28% of the LNG tankers currently on order.

As of today, there are no US-built vessels capable of carrying LNG, and no available capacity at US shipyards to build such vessels within the USTR timeframe.

At the same time, global LNG demand is expected to rise sharply through the 2030s, making timely export infrastructure and fleet availability even more critical.

The Impact: The US LNG export industry has quickly grown to become both a major revenue source for the US fossil fuel industry and a geopolitical tool, but continued growth relies on ample access to cheap and available ships.

The order risks undermining long-term LNG contracts, raising prices for buyers of US LNG, and threatening the US role as the world’s top LNG exporter.

Some LNG buyers, including certain European leaders, have already begun to question the long-term reliability of the US as a supplier. US policy shifts that adversely impact energy exports could accelerate diversification toward Qatari or Australian LNG.

The Tension: The order highlights the increasingly common tension evident in the Trump administration’s policies between protecting certain domestic industries at the expense of other, more globalized ones.

Looking Forward: Industry analysts remain unsure whether the order will result in LNG tankers being built in the US going forward, given higher costs, a lack of technical knowledge, and long time horizons needed to begin and complete construction.

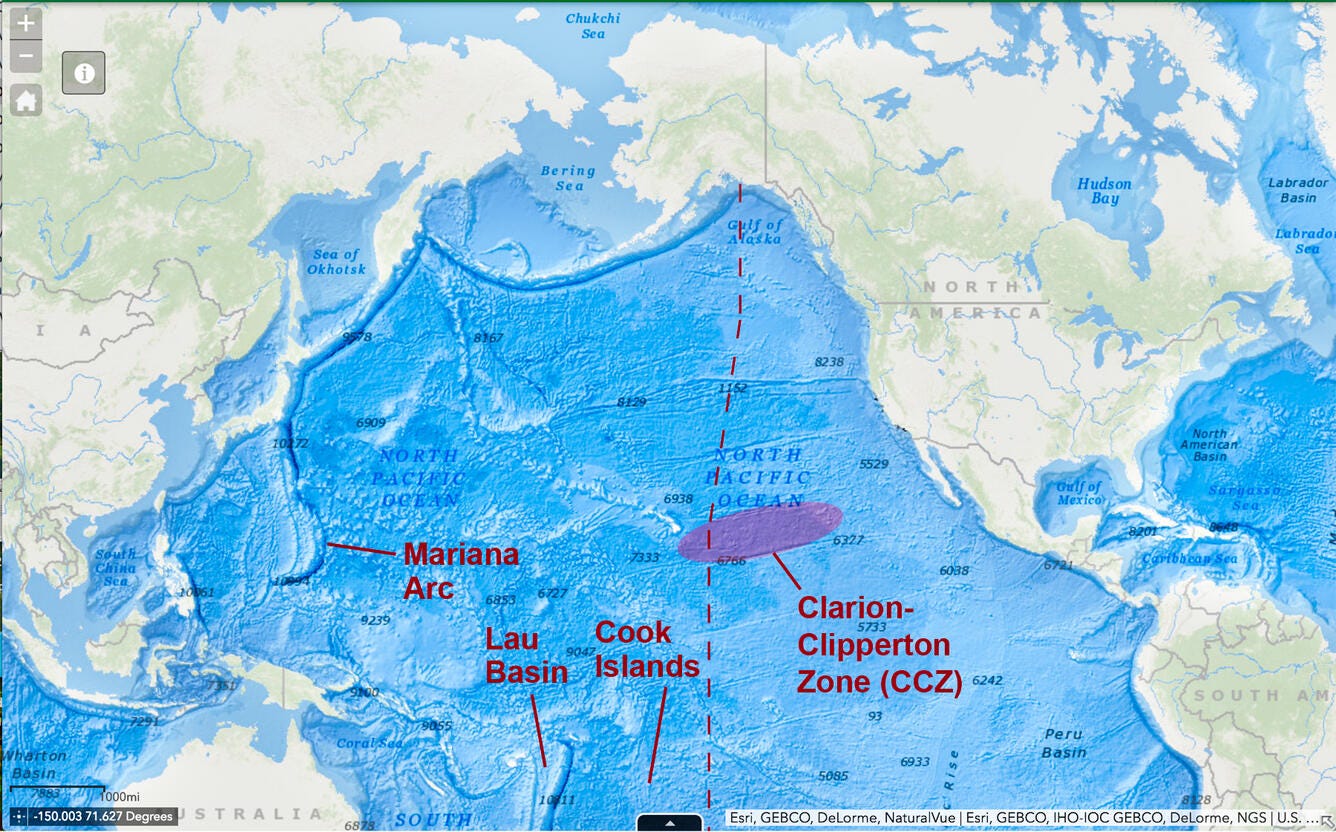

US seeks to enter deep sea mineral extraction unilaterally

Driving the News: A new executive order, Unleashing America’s Offshore Critical Minerals and Resources, aims to speed up permitting for deep sea mineral extraction projects despite international pressure.

The order issued by President Trump directs US agencies to expedite permitting for exploration and commercial recovery of minerals, report potential opportunities on the US outer continental shelf, and develop a plan to map priority areas.

The Context: Deep sea mining has become a growing interest for companies and countries around the world as the critical mineral race accelerates. However, until now, all parties have withheld any large-scale development until international agreements can be reached.

The Geopolitics: The United Nations Convention on the Law of the Sea (UNCLOS), adopted in 1982 and ratified by 170 parties, established the Jamaica-based International Seabed Authority (ISA), which has become the governing authority for mining in international waters.

While China and Russia (both UNCLOS signatories) have been exploring deep sea mining potential under ISA-granted licenses, the ISA has continued to restrict any commercial mining until questions around environmental harms, taxation, and other factors are resolved (Financial Times).

Many countries have called for total moratoriums on seabed mining, while others, including China, have chosen to refrain until a governance agreement is reached.

The US remains one of the few countries that has not joined the agreement, enabling President Trump to unilaterally decide that the country can begin issuing permits and support development of the industry (NY Times).

Blowback: The President’s announcement was quickly condemned by global actors, including the European Commission which “deeply regrets” the President’s order and China which called the action a violation of international law (Euronews, BBC).

Several US lawmakers and major environmental groups have also criticized the order, citing insufficient understanding of deep sea ecosystems and potential irreversible damage.

The executive order may also further complicate relationships with Pacific Island nations, several of which have taken strong positions against seabed mining in their territorial waters.

Looking Forward: NOAA, part of the US Department of Commerce, will be responsible for issuing seabed mining permits. While several potential deep sea mining companies are moving to take advantage of the order, it will likely take years to scale operations and the legal hurdles could be significant.

Perspective: The New Joule Order

Last month, Carlyle’s Jeff Currie and James Gutman published a report titled The New Joule Order, which I found compelling and worth reviewing in this week’s newsletter.

The Take: This paper seeks to bring a new perspective to the Energy Transition: first, that the transition is deeply intertwined with the shifting global trade order, and second, that the growing focus on energy security creates an even stronger case for localized, electricity-based energy resources.

They explain: “Fossil fuels are attractive as they can be traded. If trade is under threat, then so are fossil fuels.” As the period of free and open trade gives way to a new, more uncertain and less globalized future, relying on imported energy resources (i.e. fossil fuels) becomes risky.

As they see it, “peak oil” has entered a third (and in their view, more fatal) stage[i]: peak oil trade, wherein consumers will seek to reduce reliance on hydrocarbon imports in favor of more localized resources.

The Security Premium: For years, clean energy has been associated with a “green premium” justified by its climate benefits, but the shifting geopolitical paradigm is introducing a new, more valuable “security premium” that countries are willing to pay for reliable supplies.

In the new energy world, security is critical, and electricity is increasingly the energy of choice for consumers.

As a result, the case for localized, renewable resources strengthens considerably: despite variable supplies (which can be managed through energy storage and more interconnected grids), these resources are far more insulated from trade disruptions than traditional oil, gas, and coal.

They write: “The localization of renewable energy output was initially a flaw, but is rapidly becoming a feature.”

The Geopolitics: In the last two decades, China has made unprecedented investments in its clean energy supply chain. As the authors argue, rather than an altruistic commitment to addressing climate change, this prioritization has been driven by a desire to secure energy security and economic independence.

Separately, as the US has shifted from net energy importer to net energy exporter, it has shifted focus away from maintaining the international rules-based order that helped maintain free fossil fuel trade since the Second World War.

Looking Forward: As countries shift their focus to issues of security, a new opportunity is emerging to significantly accelerate renewable deployment if the priorities of security, affordability, and sustainability can align. “Energy independence can accelerate transition faster than environmental concerns or even economic efficiency.”

Dive Deeper: Access to the full report can be found here: The New Joule Order.

Image Sources:

[i] The term “peak oil” has had many iterations and meanings over the years. Originally, the term was coined to refer to “peak oil supply,” with a worry that the world would run out of oil in only a few decades. After innovation and adaptation led to new supplies, including the US shale revolution, the focus on “peak oil” instead shifted to “peak oil demand,” with the understanding that the world would need to phase out oil use to slow climate change. Now we are entering a third era of “peak oil trade,” wherein countries may be moving away from oil and other tradeable fossil fuels to reduce their exposure to supply interruptions.