Europe's Energy Contract Challenge

Plus how the German Port of Wilhelmshaven is becoming a green energy hub, what OPEC+ production cuts mean, Iraqi oil projects moving forward, a look at Latin America's critical minerals potential

Rendering of TES’ Green Gas Terminal at Wilhelmshaven, which will play a role in the larger Green Energy Hub to help meet Germany’s sustainable energy needs (Source: TES)

This week there are updates on energy trends in Europe including both short-term gas supply needs and the longer-term energy future of Germany. The global oil sector was also hit by a major production cut announcement last week by OPEC+, while at the same time international oil companies more broadly seem to be expanding operations to grow supply over the next decade. Finally, the IEA is looking at the potential to grow critical minerals production in Latin America to meet growing global demand.

Europe Long-Term LNG Contracts Falling Short

WHY IT MATTERS: Concern is mounting about the potential lack of secured long-term LNG contracts for the EU ahead of next winter, which would leave the EU exposed to another winter of expensive and risky spot market purchasing.

This past winter Europe was forced to rely on LNG spot markets to make up for the loss of Russian gas, which ended up costing the EU close to €400 billion on gas imports in 2022–three times the amount spent in 2021 (IEA). While necessary last winter, that sort of spending is unsustainable and jeopardizes Europe’s economic recovery.

KEY ISSUE: As China’s economy continues to revitalize in the coming months, the global LNG market will tighten and Europe will be left with no other option but to pay exorbitant prices on the spot market (Reuters).

The EU’s competing climate goals have made it harder to lock in long-term contracts (given that the bloc is seeking to phase out natural gas in the coming decades), setting up a tension between the near-term energy needs and the longer-term climate commitments.

Many Asian buyers (including China), on the other hand, are prioritizing supply security and moving forward with locking in long-term contracts.

MAJOR RISKS: As the EU looks ahead, three major risks to maintain ample store and supply include a hot and dry 2023 summer (which would reduce hydro output), a cold 2023-24 winter, and a strong economic recovery from China (and resulting natural gas demand growth).

German Port of Wilhelmshaven to Play Major Green Energy Role

WHY IT MATTERS: As Germany seeks to solidify its long term, post-Russia energy future, both the state and international energy companies are investing heavily in Wilhelmshaven as the primary point for seaborn hydrogen and ammonia importing, captured carbon storage, and other green infrastructure needs.

While Germany was able to meet its immediate needs last year by pursing a range of short-term strategies including procuring a number of floating storage regasification units (FSRU, the first of which was installed at Wilhelmshaven), the country now needs to invest in and construct its next generation of energy infrastructure.

Through this transition, Germany remains committed to addressing both its energy security and climate needs. Importing hydrogen and ammonia will play a big role, as will permanent subsea storage of captured carbon, infrastructure to support offshore win, and other cleantech.

Figure: The port town of Wilhelmshaven, located in northern Germany (Source: Reuters)

THE CONTEXT: Wilhelmshaven is Germany’s only deepwater port, and is the focus of major investment by energy companies. Reuters recently published a useful list of planned and potential projects for the port.

Three major companies just announced a total investment of over $5.5 billion, including state-controlled Uniper (pursuing the Green Wilhelmshaven project to supply as much as 10-25% of the entire German hydrogen demand by 2030), Belgian hydrogen company Tree Energy Solutions (TES hydrogen hub project), and Wintershall Dea (CO2 Hub project).

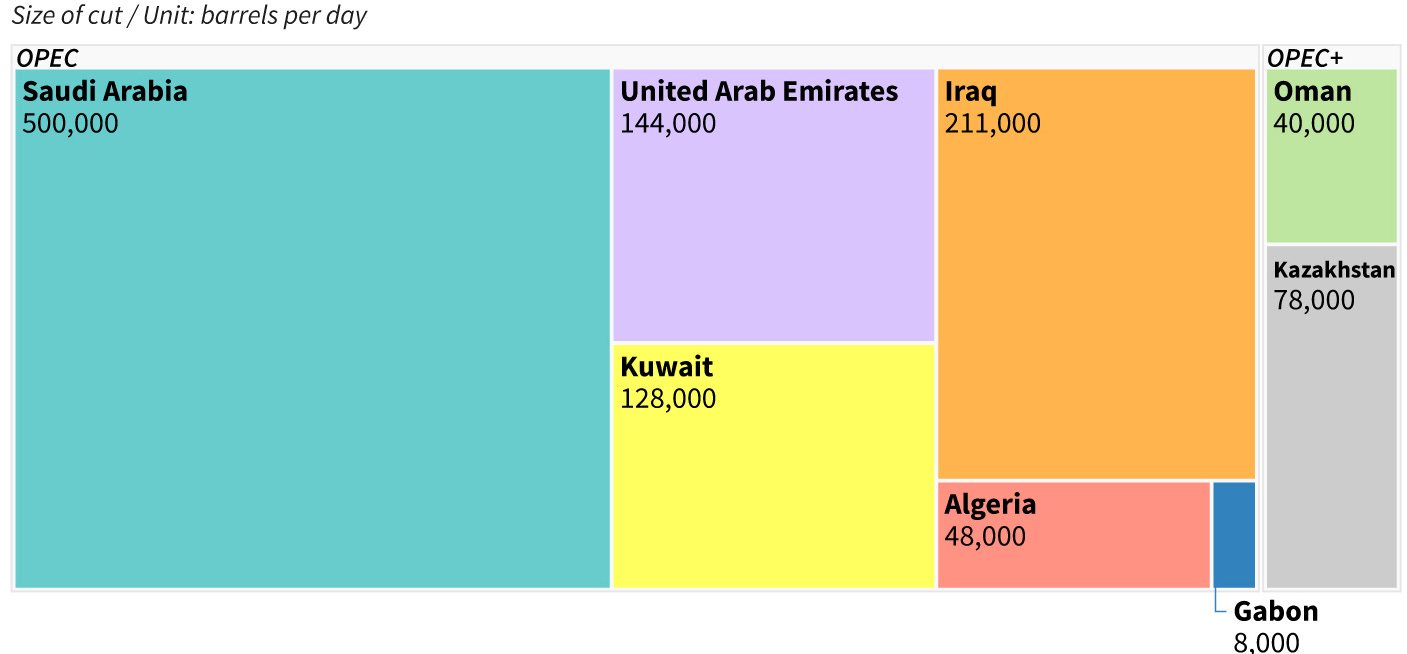

OPEC+ Production Cut and Russian Oil

DRIVING THE NEWS: Last week OPEC+ announced a surprise cuts in oil production of 1.66 million bpd starting in May. The announcement led to a roughly $5 increase to around $85 per barrel.

Saudi Arabian spokespeople say that the move was made to help stabilize the market. One of the driving factors is fear that the banking crisis could result in a reduction in demand. Russian Deputy PM Alexander Novak also pointed to the banking crisis, as well as “interference in market dynamics” by the west–a euphemism for the price cap and import bans (Reuters).

John Kirby, spokesperson for the U.S. National Security Council, responded on the behalf of Biden Administration saying: “We don't think cuts are advisable at this moment given market uncertainty - and we've made that clear… But we also don’t have a seat at that table.”

Figure: Planned cuts by OPEC+ member (Source: Reuters)

WHY IT MATTERS: No only do the production cuts risk exacerbating inflation as the Federal Reserve and other organizations still struggle to bring the economy under control, but the decision also signals an evolving geopolitical position for Saudi Arabia (one of the key proponents of the cuts) and a growing divide between the Kingdom and the U.S.

ENERGY IMPACT: While OPEC+ has justified the planned cuts by noting a potential downturn in demand from the banking crisis, other signals suggest that demand is actually more likely to strengthen, particularly as China continues to remobilize its economy (Wall Street Journal).

The Wall Street Journal identified some key Chinese sectors driving oil and gas demand currently, including transport and housing-related heavy industry–both of which are beginning to gain steam after the Covid downturn. China’s property and tourism industries are also likely to pick up more this year

SAUDI ARABIA CONTEXT: Jason Bordoff, Founding Director of the Center on Global Energy Policy at Columbia University, wrote a piece for Foreign Policy describing how the production cuts will help strengthen Saudi Arabia’s geopolitical hand. He points out Saudi’s need for revenue (amid concerns of a global economic slowdown) and the strategic benefits of reclaiming some of the Kingdom’s spare production capacity to be used at their discretion.

The article also talks about the shift in Saudi diplomatic strategy away from aligning only with United States. Saudi Arabia seems to be distancing itself from the U.S. while continuing to strengthen ties with Russia, China, and other Gulf states. This comes as the historic “oil-for-security” arrangement with the U.S. continues to wane from both sides.

RUSSIA CONTEXT: For Russia, the production cut will help tighten global markets and drive up demand.

According to the Moscow Times, Russia exported record volumes in March, averaging 3.13 million bpd (up 31.2% from the same time last year) to a range of buyers. The majority of diesel is going to Turkey, Brazil, Libya, and Morocco. And the main share of its oil products are heading to Greece and Malta. Finally, fuel exports are going primarily to UAE, Nigeria, Singapore, and India.

TotalEnergies Moves Forward with Iraqi Oil Project

WHY IT MATTERS: Many international oil companies have remained hesitant to invest in major projects in Iraq, but this recent announcement suggests that the higher level of political stability may usher in a new wave of investment.

DRIVING THE NEWS: TotalEnergies has announced it is moving forward with partners on a $10 billion Gas Growth Integrated Project (GGIP). The project will include TotalEnergies (45% stake), QatarEnergy (25%) and Iraq’s Basrah Oil Company (30%) (TotalEnergies press release).

The announcement builds on an agreement first made in 2021, which stalled due to political uncertainty. Since then, talks have accelerated under new Iraqi Prime Minister Mohammed al-Sudani which provided a “a strong and positive signal for foreign investment in the country” according to Total (WSJ).

THE WIDER TREND: In addition to the investment in Iraq, this announcement traces a broader pattern of global oil companies investing more in major projects around the world. Driving factors likely include the windfall profits that many oil major saw in the last year, as well as a renewed perspective from the industry about the longevity of demand.

IN RELATED NEWS: An initial agreement has been reached between Iraq’s federal government and the Kurdistan Regional Government (KRG) regarding export from the region. “Following several meetings between the KRG and federal government, an initial agreement has been reached to resume oil exports jointly through Ceyhan [in Turkey] this week,” wrote Lawk Ghafuri, head of foreign media affairs for the KRG (Al Jazeera). The agreement next has to be approved by the Iraqi parliament.

IEA Commentary on Latin America’s Role in Critical Minerals

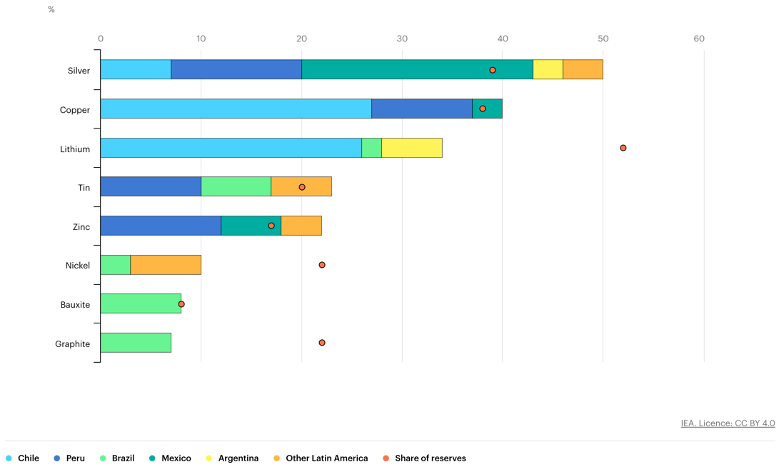

DRIVING THE NEWS: This week the IEA published a commentary by three energy experts that examines Latin America’s potential role in the future critical minerals supply chain for the clean energy transition.

KEY TAKEAWAYS: While Latin America is already a major supplier of critical minerals including lithium and copper, there is significant opportunity for the region to both expand current production and become an important supplier of additional minerals including graphite, nickel, manganese, and REEs to help avoid global shortfalls.

The region currently supplies 35% of global lithium–led by Chile at 26% and Argentina at 6%–but is understood to hold over half of the world’s lithium reserves. Latin America is also a leading producer of copper (40% of global supply) led by Chile at 27%, Peru at 10%, and Mexico at 3%.

Brazil alone holds roughly 20% of the world supply of each of graphite, nickel, manganese, and REEs, which presents a major opportunity for expansion. The chart below highlights some additional resources where Latin America is currently producing under potential:

Figure 3: Latin America share of production and reserves of selected minerals, illustrating opportunities to expand across several mineral types (Source: IEA)

In order to realize this potential, the IEA report identifies a number of key enabling policies and actions:

Update existing national geological surveys, which would benefit future exploration and fill in gaps where current geological surveys fail to identify energy-related critical minerals. This can be a key step in attracting foreign investment in the sector.

Implement stronger environmental and local community impact mitigation, which includes environmental regulations and stakeholder engagement programs. The piece notes: “ESG issues are already the top concern for international mining companies.”

Ensure a fairer distribution of wealth from the natural resources. The commentary also explains: “Lack of local benefits from mining projects, or perceptions thereof, are a prominent cause of social unrest, with protests halting mining operations or slowing new developments.”