Russia's final major gas exports to Europe expire

Plus the top macro energy trends shaping 2025, a shadow fleet vessel seized in Finland for suspected undersea cable sabotage, and the final much-anticipated rules on US clean hydrogen subsidies

But first, welcome back to The Global Energy Lens!

After a long hiatus, I’m excited to resume these regular briefings on the intersections of energy, climate, and geopolitics. This newsletter began as a collaboration with the Harvard Kennedy School and the Belfer Center’s Geopolitics of Energy Project, but it has since evolved into an independent publication, now rebranded as The Global Energy Lens.

My goal remains the same: to distill the most important global developments in energy transition, climate change, and international affairs into concise, insightful updates. Thank you for rejoining me on this journey—I hope you find these briefings as engaging and thought-provoking as ever. Let’s get going:

This week we highlight some of the major global energy trends unfolding in 2025, including shifting policies and geopolitical positions, the challenges associated with datacenter expansion, and the evolving nuclear renaissance. In the news, Ukraine allowed the agreement for Russia’s final major natural gas artery into Europe to expire, Finland detained a vessel suspected of sabotage related to the Christmas Day Estlink 2 subsea cable severing, and the US issued its final rules on clean hydrogen subsidies, paving the way for greater certainty in investment.

What’s coming in 2025?

As 2025 gets underway, let’s take a moment to examine what energy transition trends are driving the conversation for the new year. Reading through nearly a dozen of the top outlooks for 2025, here are six trends that keep appearing for the year ahead:

The New US Administration: With the Trump Administration taking office later this month, uncertainty about the future of the US energy sector and climate action is high. A few themes, however, are very likely based on Trump’s first term and rhetoric on the campaign trail: oil and gas will be at the center of the new administration’s energy policy, a major reversal on key climate actions will occur (including withdrawing the US from the Paris Agreement, again), weakening of rules like methane regulations, approval of pending LNG export projects, and changes in the country’s overall foreign policy approach that will likely cascade through the global economy. While a full repeal of the IRA energy provisions is unlikely, it is entirely possible that partial repeals by Congress will be taken through the budget reconciliation process, and that additional friction to certain provisions will be added through new policies and regulations at the Department of the Treasury, DOE, and other agencies.

AI and Datacenters: The accelerating demand for AI and datacenters is continuing into 2025, with the power demand for datacenters expected to grow 10-15% per year between now and 2030 (S&P Global). Grid infrastructure and ample power supply continue to be a challenge. Datacenters take 2-3 years on average to go from inception to commercial operations, while new generation can take 4-5 years or more, and far longer for enabling transmission. As a result, energy shortages for new datacenters will likely grow as a challenge for tech companies in 2025, leading many to further expand their efforts to secure supplies directly.

Resurgence of Nuclear Power: To that end, over 3 GW total of power purchase agreements for nuclear power were signed by Google, Amazon, and Microsoft in 2024 to address datacenter demands. This resurgence is part of a larger trend in the nuclear industry, driven by the growing hunt for zero-carbon baseload generation and improved energy security. Efforts are underway in the US to restart retired facilities at Palisades (MI) and Three Mile Island (PA), while France is planning to increase its nuclear output and Japan is on track to restart several of its shuttered reactors.

China Taking the Lead: As the US and Europe waver in their pursuit of a clean energy transition, China is pulling ahead as the global leader in cleantech and the geopolitical climate conversation. China is set to install nearly 60% of all renewable capacity added between now and 2030 (IEA), and domestic EV sales have already exceeded 50% of all light duty vehicles sold (S&P Global). Also the world’s largest emitter, China seems to be positioning itself as a reliable alternative to lead the world’s climate action, particularly as the US withdraws. Importantly, as the US and Europe institute trade barriers such as tariffs on Chinese cleantech, they will struggle even more to keep pace and risk substantially hurting emission reduction progress.

Energy Security Remains Front-of-Mind: As countries contend with an ever more complex geopolitical environment, securing ample and reliable energy supplies will remain a top priority. Conflict in the Middle East continues to be a major concern, including Iran’s potential involvement in the Israel-Hamas war and the exposure of nearly 20% of the globe’s oil and gas volumes that transit the volatile Strait of Hormuz. Beyond supply security, countries and governments are also focused on physical and cyber security of energy assets. A recent PwC report noted: “The overall threat level to the energy sector globally is assessed as CRITICAL.”

Easing Interest Rates: After contending with high interest rates in recent years that have slowed investment in energy transition, global inflation is finally coming under control. Central banks are expected to further lower interest rates in 2025, reopening the doors for more affordable financing. M&A activity in the sector is likely to increase. Looking ahead, KPMG identified the four organizations most active in funding, developing, and acquiring energy transition projects: integrated energy companies (including O&G), energy intensive businesses, VC/PE, and infrastructure funds.

DIVE DEEPER: These six trends are just a sample of the myriad outlooks for the coming year. For more complete trends and perspectives, including on topics of LNG, hydrogen, energy prices, government policy, and OPEC’s troubles, see the many sources referenced here: IEA World Energy Outlook, S&P Global, Mitsubishi Heavy Industries, Wood Mackenzie, Economist Intelligence, KPMG, and PwC

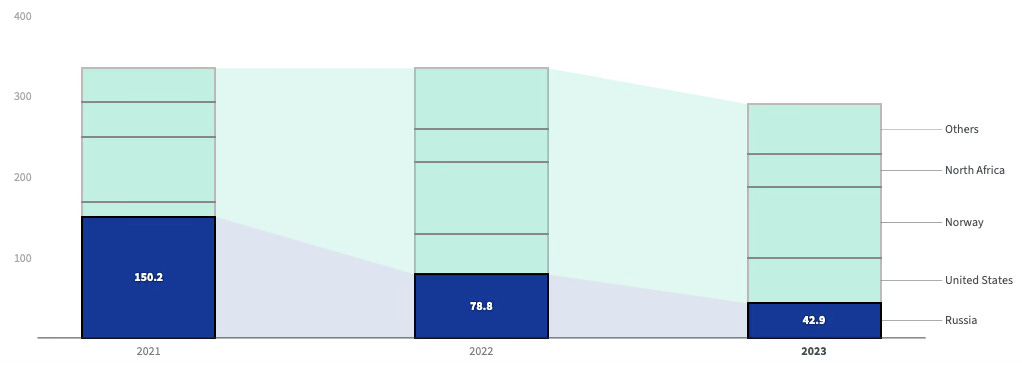

Ukraine allows transit agreement of Russian natural gas to expire

DRIVING THE NEWS: At midnight on December 31st, Ukraine’s President Volodymyr Zelensky allowed the 5-year transit agreement to expire in a much-anticipated move.

President Zelensky had warned for months that Ukraine would allow the agreement to expire without renewal, giving time for the remaining European countries that purchase Russian gas to adapt. (NY Times)

The move shuts down the last major corridor for importing Russian natural gas to Europe, which the bloc says it was well prepared for. In a statement, the European Commission noted: “thanks to efficient preparatory work and coordination in the region and beyond, there are no security of supply concerns”. Natural gas storage levels currently sit at 72%, above the average of 69% this time of year. (European Commission)

THE IMPACT: The expiration cuts both ways, with Ukraine likely to lose up to $1 billion per year in transit fees while Russia misses out on an estimated $5-6.5 billion per year in gas sales. (Reuters)

For its part, Russia feigned indifference, with President Vladimir V. Putin in a mid-December news conference on the agreement expiration stating: “That’s fine – we will survive, Gazprom will survive.”

MEANWHILE IN EUROPE: While most countries have transitioned away from Russian natural gas following the invasion of Ukraine, Austria, Hungary, and Slovakia still purchase large quantities of Russian energy.

Discussing the shutdown of the Ukrainian pipelines, Austrian Energy Minister Leonore Gewessler said, “We did our homework and were well prepared for this scenario” and confirmed the country has secured alternative supplies.

Moldova is perhaps the hardest hit. The country has issued emergency measures to support citizens particularly in the breakaway region of Transdniestria (a pro-Russian region) where heating and hot water have been shut off. Regardless of this transit expiration, however, Gazprom had said it would halt supplies to Moldova on Jan. 1, citing unpaid debt (a claim strongly contested by the Moldova government). (AP News)

AT THE SAME TIME: Europe is contending with an extended Dunkelflaute: a period of calm days with dense clouding that can significantly reduce the power generation from renewables. As European countries have increased the use of wind and solar, these weather events covering multiple countries at once have a growing impact on supply, driving up prices and causing friction between neighbors that typically share power supplies. (NY Times)

As countries like Norway and Sweden export more to meet the shortfall in Germany and Denmark, for example, prices can rise causing anger. Amund Vik, a former Norwegian deputy energy minister and now a senior adviser to Eurasia Group, was quoted saying that the situation with high power prices have “created this kind of political backlash against cables.”

Finland seizes Russian shadow fleet tanker on suspicion of sabotage

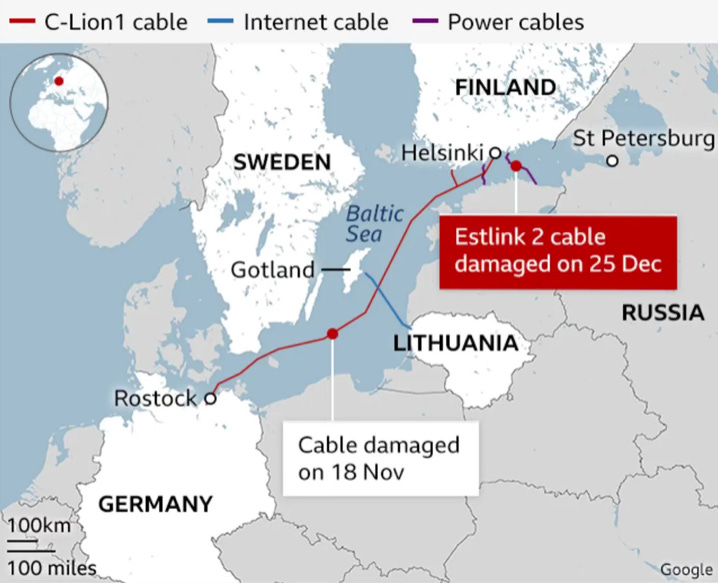

DRIVING THE NEWS: Following the December 25th incident in which a major subsea power cable and several communication cables running between Finland and Estonia were severed, Finnish authorities have seized a suspected vessel.

On Christmas Day, the 658 MW Estlink 2 subsea power cable that exchanges power from Finland to Estonia was cut along with several fiber optic communication lines. While a parallel 358 MW cable remains intact (Estlink 1), Estonia has had to turn to emergency measures including importing power from Russia to make up the shortfall. (Financial Times)

The aging vessel, named the Eagle S, is reportedly part of Russia’s shadow fleet of oil tankers used to circumvent international sanctions. According to tracking data, the Eagle S was transporting oil from Russia to Egypt and was located near the cable at the time of incident. The ship was seized upon entering Finnish waters in the Baltic Sea.

Estonia’s Foreign Minister Margus Tsahkna said they cannot “rule out deliberate damage to the cable. There have been too many incidents [in the] Baltic Sea that coincidences are becoming unlikely.”

WHY IT MATTERS: The Estlink 2 in the latest in a growing trend of attacks on critical undersea infrastructure, particularly in and around northern Europe.

Undersea power transmission lines play a key role in Europe’s ability to trade electricity between countries, which has become especially important in recent years due to rapid energy system changes brought on by the transition away from Russian gas supplies, growing deployment of renewables, and other factors.

THE GEOPOLITICS: Russia’s suspected involvement in these attacks is further aggravating relations with Europe and NATO. Following the December 25th incident, NATO announced it will increase its presence in the Baltic sea.

President Alexander Stubb of Finland said: “We have agreed with Estonia, and we have also communicated to NATO Secretary General Mark Rutte, that our wish is to have a stronger NATO presence". Soon after, Secretary General Rutte confirmed on X that NATO will “enhance its military presence in the Baltic Sea”. (Reuters)

In parallel, Estonia announced a new naval operation to protect the remaining Estlink 1 cable, while Sweden confirmed it would deploy additional air and sea resources to monitor vessels in the region.

Questions of jurisdiction can be challenging in international waters. For one recent incident involving a Chinese ship, the vessel sat parked at sea for a month before China sent investigators to board with observers from Sweden, Denmark, Germany, and Finland. One of the lead investigators, however, was stopped from boarding and the ship soon resumed its journey out of the region shortly thereafter.

DIVE DEEPER: In May 2024, NATO launched its new Maritime Centre for Security of Critical Undersea Infrastructure in response to the growing threat (NATO). See also a recent post from the Center for Strategic & International Studies discussing the importance and vulnerability of this critical infrastructure.

US Dept. of the Treasury releases final rules on hydrogen tax credits

DRIVING THE NEWS: On Friday, January 4th the US Department of the Treasury released its much-awaited final rules for the 45V Clean Hydrogen Production Tax Credit, which prioritize growth of the nascent clean hydrogen industry more heavily than strict greenhouse gas emission requirements. (Dept. of the Treasury)

The final rules considered roughly 30,000 public comments and clarified key requirements for how hydrogen producers can claim tax credits, including defining factors such as temporal matching, deliverability, and incrementality.

Compared to the originally proposed rules, the final rules include more flexibility for producers, notably allowing annual rather than hourly renewable energy matching until 2030 and the counting of nuclear power generation, provided the hydrogen project averts the planned retirement of a qualifying reactor.

WHY IT MATTERS: The final rules help bring more certainty to the clean hydrogen industry, which has been held in limbo since the passage of the Inflation Reduction Act in 2022 as developers and investors awaited clarification.

Responses to the new rules were mixed: the American Petroleum Institute released a supportive statement highlighting that the guidance enables natural gas paired with CCS to compete “more fairly” in the hydrogen space. In contrast, the Clean Air Task Force expressed concern and disappointment about the reliance on reporting and monitoring requirements for the O&G industry, and the delay of the hourly matching requirement from 2028 to 2030.

While the final rules are now published, larger uncertainties still remain as the Trump Administration takes office later this month. While it is unlikely that President-elect Trump will enact a wholesale scrapping of the IRA (a move both extremely difficult and unpopular even among his own party), his administration could reverse or stall certain components including the clean hydrogen tax credits.

THE GEOPOLITICS: As the clean hydrogen sector seeks to ramp up globally as a key part of the energy transition, the US is working hard to grow its role quickly. John Podesta, President Biden’s chief clean energy advisor, said of the new Treasury rules: “The extensive revisions . . . provide the certainty that hydrogen producers need to keep their projects moving forward and make the United States a global leader in truly green hydrogen”.

Europe is also making a push to capture some of the emerging clean hydrogen industry. Their approach is based more on sticks than carrots, however, including the EU Renewable Energy Directive which mandates a certain percentage of renewable hydrogen be used in their industrial sectors. This approach may be helpful in addressing the demand-side challenges the US is still dealing with. (see CGEP)

DIVE DEEPER: How much can a Trump Administration really do to reverse the IRA clean energy incentives? This piece from Norton Rose Fulbright has a good discussion of what actions the executive can take with regard to the IRA (hint: final regulations such as those just released for clean hydrogen are more difficult to reverse than proposed rules).