Shifting Currents in US Energy & Foreign Policy

The Ukraine-US critical minerals agreement, the impacts of tariffs on the energy sector, how Europe is thinking about Russian energy imports, and the IEA's ideas for improving critical supply chains.

This week, we look at two rapidly evolving US foreign policy issues: the Ukraine-US critical minerals agreement and the proposed tariffs on Canada and Mexico. In Europe, plans to permanently eliminate Russian energy imports are in limbo. And the IEA is examining ways to improve the global transmission infrastructure and critical mineral supply chains.

Note: Several of the stories covered in this week’s newsletter are evolving in real time. This publication is as of March 7, 2025, and may become outdated as policies evolve.

US-Ukraine Mineral Deal Swings

DRIVING THE NEWS: Last Friday, the proposed mineral agreement between the US and Ukraine nearly imploded after a White House meeting between Presidents Trump and Zelensky devolved into chaos, resulting in a canceled joint press conference and no signature on the deal.

In the days since, the US has announced a pause on all military aid and intelligence sharing to Ukraine (Bloomberg), while European leaders have reaffirmed their support for the embattled country (NPR).

Despite the rift, however, both President Zelensky and President Trump have stated that they are still open to the agreement and plan to move forward with signing (BBC, Reuters).

THE CONTEXT: Even before last Friday’s White House meeting, the road to an agreement had been rocky. The US has continually rejected any specific security guarantees sought by Ukraine, and after an initial refusal by Zelensky of the US maintaining 100% financial interest in the fund, Trump lashed out, calling him a “dictator” and falsely blaming Ukraine for starting the war.

Olha Stefanishyna, Ukraine’s deputy prime minister and justice minister, has noted that the minerals deal sits within a larger framework of negotiation, saying, “The minerals agreement is only part of the picture. We have heard multiple times from the US administration that it’s part of a bigger picture.”

DEAL STRUCTURE: The agreement centers on the creation of a “reconstruction investment fund” into which Ukraine will contribute 50% of the proceeds from the “future monetization” of mineral resources owned by the state, including oil, gas, and critical minerals (Financial Times).

The fund is to be jointly owned by the two countries, with the exact shares and the definition of “joint ownership” still to be determined after the agreement is signed

Details on how the fund will be distributed also remain in limbo, though it is likely that a large portion will be invested back into Ukraine to fund post-war reconstruction while some portion may be paid to the US.

The agreement covers only those resources developed in the future (excluding all existing resource revenues), including a range of oil, gas, coal, lithium, graphite, cobalt, titanium, and some rare earth elements that are owned in whole or in part by the Ukrainian government.

THE GEOPOLITICS: While the US argues that increasing economic ties with Ukraine will be enough to deter future Russian aggression, Ukraine remains concerned about the lack of security guarantees as part of the deal.

One of the catalysts of Friday’s White House argument was Zelensky’s accurate listing of the multiple times that Russia has broken its peace promises, insisting that any negotiated peace must be backed up by Western security guarantees in order to last.

LOOKING FORWARD: Should the agreement be signed, it will then require ratification by Ukraine’s parliament, which (prior to the White House meltdown) had signaled debate it but not rejection it outright. The agreement makes no mention of congressional approval needed in the US.

Even if the agreement is made, it will still take years to decades and major investment before these new mineral resources begin generating revenue. Theoretically the fund could be used to invest in such projects, but would need to grow on the back of external investment to start.

DIVE DEEPER: The Center for Strategic & International Studies (CSIS) has published an in-depth look at the specifics of the US-Ukraine mineral deal.

New Reports from the IEA Highlight Pathways for Stronger Supply Chains

DRIVING THE NEWS: The IEA released two new reports back-to-back that discuss some of the key challenges and propose actionable steps to improve two supply chains that are critical to enabling the energy transition.

FIRST, TRANSMISSION: The agency examined the growing headwinds from rising costs and procurement lead times in the global transmission infrastructure industry, noting that both have doubled since 2021 (Building the Future Transmission Grid).

The report states that “inadequate transmission remains a major constraint on power system development, electrification, and energy security.” The growing demand for electricity driven by industry and the rising use of air conditioning, electric vehicles, heat pumps, appliances, AI, and other needs around the world will continue to strain existing infrastructure, and that transmission systems cannot keep up with new renewable sources being added to the grid.

While investment in transmission has started to pick up—particularly in Europe, the US, China, India, and parts of Latin America—additional investment and equipment supplies are still needed.

The IEA put forth eight “actionable recommendations”, including improved market signals via increasing visibility of future transmission component demand, policy changes to improve industry coordination and streamline permitting, implementing new procurement frameworks, and workforce development.

SECOND, MINERAL TRACEABILITY: The IEA’s second report makes the case for improving mineral traceability—the ability to transparently track commodities from mine to end use—as a way to support key policy objectives and strengthen supply chains (The Role of Traceability in Critical Mineral Supply Chains).

Their argument is one that has been made in other commodity sectors, namely that by implementing strong traceability practices, policies enacted by demand countries and claims made by suppliers can be vetted across the supply chain, differentiating compliant vs. non-compliant sourcing.

The report notes a number of countries that have already implemented some forms of traceability requirements, including the EU and US on the demand side, and Rwanda, the DRC, and Tanzania on supply side. Colombia also called for improved traceability at this year’s UN Biodiversity Conference of Parties, while still others have put in place policies to encourage adoption.

The IEA outlines an eight-step roadmap for increasing mineral traceability, which importantly highlights the need for interoperability across different operators and jurisdictions.

THE GEOPOLITICS: One theme underpinning both reports is the persistent issue of concentrated supply chains, and the risks they pose to energy security and decarbonization efforts.

China, for example, is by far the leader in critical mineral production and—more importantly—refining, while also being the top exporter of transformers critical to transmission systems.

As supply chains for these critical energy transition components continue to develop, addressing these core challenges and implementing strong practices like traceability from the beginning will improve transparency and security going forward, as well as enhance the competitiveness of suppliers looking to sell into major markets.

How US Tariffs Impact the Domestic Energy Sector

DRIVING THE NEWS: In recent weeks the Trump Administration has been threatening, implementing, halting, then re-threatening unprecedented trade tariffs on Canada and Mexico—two key economic partners in nearly every sector, including energy.

Most recently, the US announced a plan which includes 10% tariffs on Canadian energy imports (a concession from the base 25%) and 25% tariffs on all Mexican imports, including energy.

While the implementation of such tariffs seems to be changing day by day, the implications of what these high import taxes would mean for the US and global energy market are becoming clear.

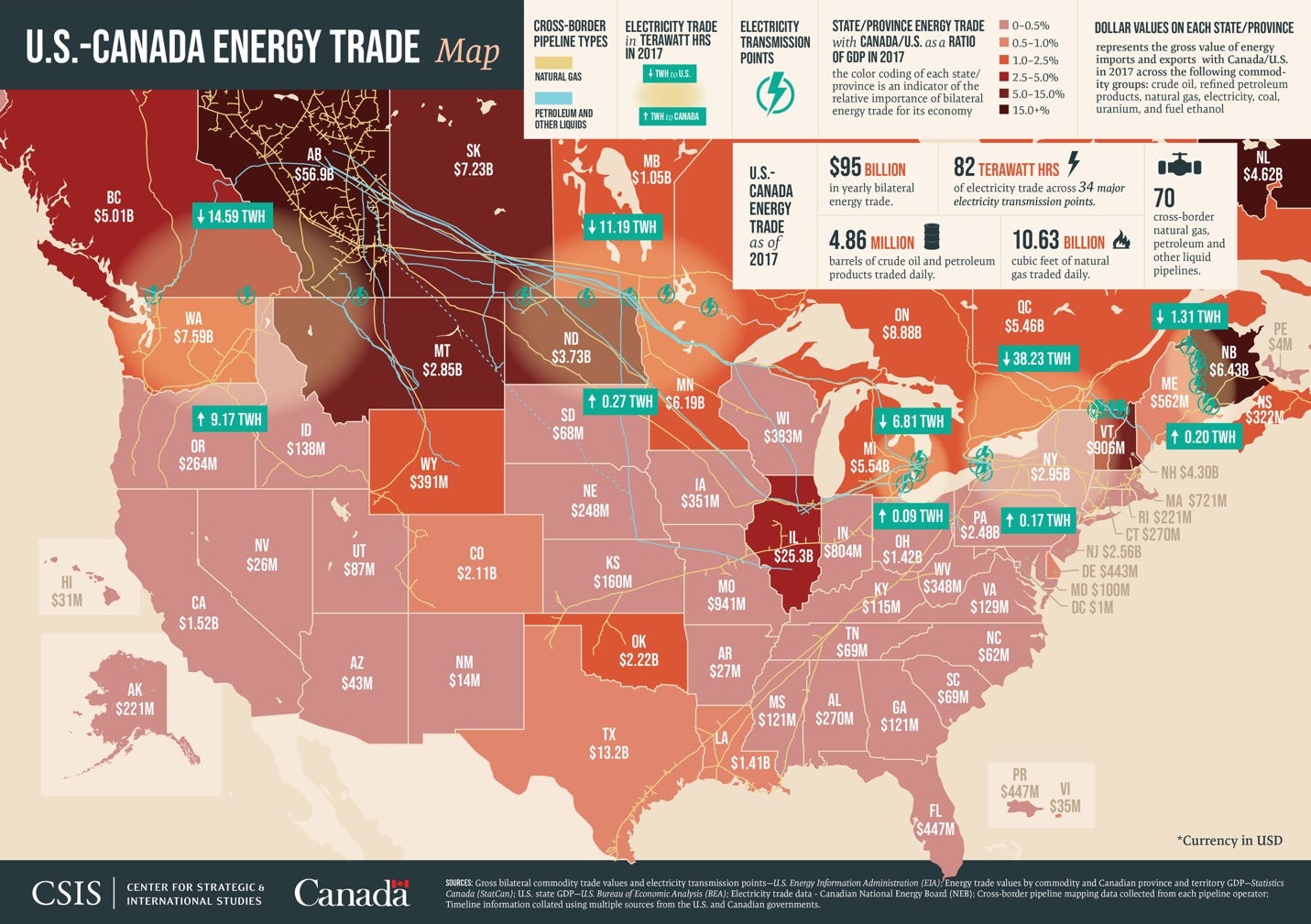

THE CONTEXT: As with other parts of the economy, the energy supply chains across the US, Canada, and Mexico are deeply linked, meaning any trade disruptions would have adverse effects on all three.

Canada supplies roughly 60% of US oil imports (4.2 million barrels per day of crude), followed by Mexico which provides 600,000 bpd (EIA). Many US refineries, particularly in the Midwest and Rocky Mountain regions, have invested heavily in infrastructure to process the extra-heavy sour crude from Canada, which would be difficult to substitute in the near term (Forbes).

Canada also provides direct electricity exports to the US, particularly to northern states close to the border. Any supply interruptions would be extremely difficult to manage due to grid stability issues on both sides of the border.

Both countries also play an important role in the critical materials trade that impacts US energy infrastructure. Canada provides roughly 50% of US nickel and 60% of imported aluminum, while Mexico is the largest supplier of electric transformers, all of which would be liable for tariffs.

THE IMPACT: Energy affordability and energy dominance are two key priorities for the Trump Administration. While the Canada and Mexico tariffs may have limited direct impact on US consumers, the costs will be felt heavily by US refiners, manufacturers, and other sectors.

US utilities are also likely to feel the pain, as many noted potential tariffs as a key threat to their businesses at the end of last year. Many utilities have been expanding their plans for capital investment in transmission and other infrastructure, which are at risk of further cost increases, longer lead times, and project delays.

They also noted that worsening economic conditions often lead to lower electricity use by customers, further weakening their bottom lines (Utility Dive).

In addition, the tariffs on key material imports from Canada and Mexico work counter to the US efforts to reduce dependency on Chinese supply chains. With similar sanctions being considered or implemented elsewhere, there are few alternative suppliers to turn to for immediate relief.

THE GEOPOLITICS: In their assessment of the broader US tariff threats, researchers at the Columbia Center on Global Energy Policy put it bluntly when they described the Trump Administration’s actions as “another step toward weaponizing America’s central role in the global financial system, value chains, and as an export market as tools to try to influence the policies of other countries” (CGEP).

Beyond the Canada and Mexico tariffs, the increasingly isolationist policies of the US may further hurt domestic energy industries, as key buyers of US LNG, crude oil, and refined fuels search for other suppliers.

DIVE DEEPER: Reuters has some good data on how US energy trade may be impacted by tariffs and trade retaliation. For more on the US-Canada energy interdependency, see this report from CSIS published back in 2018.

EU Proposal to Permanently End Russia Energy Reliance Paused

DRIVING THE NEWS: The European Commission has delayed the release of its much-anticipated plan to eliminate Russian energy imports amid increasing geopolitical uncertainty (Reuters).

THE CONTEXT: Following the bloc’s non-binding goal of ending Russian natural gas imports by 2027, EU Energy Commissioner Dan Jørgensen had promised to put forth a clear proposal for eliminating Russian gas, oil, and nuclear fuel from the EU’s energy system.

The plan was originally expected later this month but has been delayed, with officials citing “geopolitical developments” and increasing uncertainty.

THE GEOPOLITICS: The delay comes as multiple pieces are moving at once: the US has changed its tone on relations with Russia, EU officials are meeting with US counterparts to discuss trade (likely leading to commitments to increase imports of US LNG), and the European the industrial sector is calling for policies to help improve competitiveness against China and the US.

Citing these challenges, Commissioner Jørgensen noted, “We need to be mindful that we could not have done the decrease in dependency from Russia without energy from … the U.S… They really have been our friends and I hope, of course, that we will continue to be friends.” (Politico)

THE INTRIGUE: The delay comes as European countries struggle to align their priorities across the energy trilemma of energy security, affordability, and sustainability.

Just last month, Estonia, Latvia, and Lithuania—three former Soviet states now part of the EU and NATO—completed their years-long efforts to sever links with Russia’s power grid and re-synchronize instead with the EU. Following the successful switch, Lithuanian Energy Minister Zygimantas Vaiciunas stated: “We are now removing Russia’s ability to use the electricity system as a tool of geopolitical blackmail” (BBC).

At the same time, Russia’s share of gas imports to the EU rose in 2024 as member states contested with high energy prices and the resulting political blowback (Eurostat).

LOOKING FORWARD: Uncertainty will likely continue in this space as US foreign policy remains in flux, the Ukraine-Russia war rages on, and shifting global dynamics complicate Europe’s energy transition away from Russian supply.

Thanks for reading! If you found this newsletter insightful, feel free to share it with someone who might enjoy it. - Gray