The End of Germany's Nuclear Power Era

Plus Taiwan's energy security concerns, Hungary redoubling its energy dependence on Russia, Turkey bringing new gas to market, and takeaways from last weekend's G7 Energy & Environment Meeting

G7 Energy & Environment Ministers met in Sapporo, Japan this weekend to discuss the global “Green Transformation”—setting ambitious renewables goals but stopping short of committing to a full coal phase-out (Source: Reuters)

This week we’re looking at a number of key trends. First, Europe’s clean and secure energy future, which was made less certain after Germany finalized the phase-out of its last remaining nuclear generation and Hungary decided to extend its energy agreements with Moscow. Second, what role energy plays in national security for Taiwan, and what lessons the island can draw from the Ukraine-Russia conflict to prepare itself for energy shortages. And finally, how the leaders of the wealthy G7 countries are struggling to balance climate action with energy security.

Germany Shuts Down Final Nuclear Power Plants

DRIVING THE NEWS: This week Germany shut down its final three remaining nuclear power reactors, waning the country completely off nuclear (Wall Street Journal).

WHY IT MATTERS: While the final three reactors represented only 6% of the country’s total electricity generating capacity (down from 29.5% in 2000), the broader trend away from nuclear power runs counter to most developed economies, which are redoubling efforts to increase nuclear.

Many countries see nuclear as a solution for both energy security and climate change. France is pursuing a $57 billion plan to build new reactors, Poland will break ground on the country’s first reactor in 2026, and excitement for next-generation nuclear such as small modular reactors is gaining momentum around the world.

The move has been fiercely debated across political lines. Economy and Energy Minister Robert Habeck stated: “The security of energy supply in Germany was guaranteed during this difficult winter and will continue to be guaranteed.” On the other side, Freidrich Merz, leader of the Christian Democrats (the largest opposition party in German parliament), responded: “No other country is reacting to the Ukraine war and the worsening energy supply situation like Germany.” (Washington Post)

THE CONTEXT: The official phase-out began in 2011 when then-Chancellor Angela Merkel announced a plan to shut down all 17 of the country’s remaining reactors by 2022. The announcement came just three days after the Fukushima disaster in Japan.

Looking back, however, the anti-nuclear lobby has been a powerful political force in Germany for decades, particularly after the Chernobyl disaster in 1986 and re-galvanized again by the Fukushima leak in 2011.

LOOKING FORWARD: The final phase-out of nuclear power comes at a questionable time as Germany and the rest of Europe is already preparing for next winter’s energy challenge. Germany was able to weather the 2022-23 season, but got lucky with both mild winter weather and the ability to stockpile Russian gas over the 2022 summer—a supply that is no longer available.

Notably, German Chancellor Olaf Scholz also extended the retirement date for these three reactors by 3.5 months to get through the winter. While the absolute necessity of this electricity supply was unclear (the country may have had enough power without the nuclear), the move signals the importance of this power source for reassurance and redundancy in the middle of winter.

Taiwan’s Energy Security Concerns

THE CONTEXT: This week China concluded military drills around Taiwan. The show of force came in response to Taiwan President Tsai Ing-wen’s visit to the U.S. and included, among other things, exercises meant to simulate an aerial blockade of the island (for a full list of Chinese military activity since April 2, see CSIS’s tracker).

WHY IT MATTERS: In the case of an actual blockade, energy would quickly become a paramount issue for Taiwan given its near-total reliance on imported fossil fuels. This strategic weakness is a clear point of concern for the island, and way that China could inflict major economic and social consequences without deploying direct military force on the island.

Taiwan’s options for energy security are very limited. Unlike Ukraine which was able to take emergence action by detaching from the Russia and Belarus grid and connecting to the EU grid[1], as an island there are no alternative interconnection options.

THE CONTEXT: In 2021, the Taiwan relied on imports of fossil fuels for 97.7% of its total energy supply, including coal and gas for 81.5% of its electricity generation. Despite this reliance, the country has only very limited stockpile capacity: 11 days of gas, 39 days of coal and 146 days of oil. (The Diplomat)

Figure 1: Taiwan's energy consumption, illustrating continued reliance on coal, natural gas, and oil—all of which must be imported (Source: Wall Street Journal)

Because gas accounts for 37% of the island’s electricity generation, a Chinese blockade on gas imports would start having very real consequences in under two weeks. The country is working on increasing storage facilities from 11 to 20 days by 2030, but even so the country’s resilience in the face of a blockade would be limited (Reuters).

LOOKING FORWARD: While domestic energy sources are highly limited (fossil fuel supplies are non-existent, and land-intensive renewables such as solar are limited), the island does potentially have strong wind and geothermal resources. Taiwan is currently behind on its target to achieve 20% renewables by 2050, but the government has recently committed $29.5 billion before 2030 to upgrade its aging grid and invest in green technology research and deployment (Wall Street Journal).

Hungary Signs New Energy Deals with Russia

DRIVING THE NEWS: Hungarian Foreign Minister Peter Szijjarto has announced a new deal with Russia to ensure energy supplies going forward. Gazprom has agreed to allow Hungary to import natural gas at volumes above its existing long-term contract, and to potentially allow for delayed payments (Bloomberg).

“As long as the issue of energy supply is a physical issue and not a political or ideological one, like it or not, Russia and cooperation with Russia will remain crucial for Hungary’s energy security,” Szijjarto said (Washington Post).

Hungary will continue to receive Russian gas through the Turkstream pipeline with an agreed price cap of €150 per MWh.

THE CONTROVERSY: Hungary has been one of the few EU countries to continue semi-friendly diplomatic relations with Russia, and has been a staunch defender of its Russian energy supply in the face of EU sanctions and bans.

Since the first EU proposals for sanctions and bans on Russian energy, Hungary has pushed for waivers in the name of energy security (look back at Hungarian positions in 2022 on natural gas and crude oil). Hungary has also continuously threatened to veto certain EU proposals for putting economic pressure on Russia.

In response, Ukrainian officials said that Hungary’s agreements to continue purchasing Russian energy will only prolong the war. “You have to be completely blind not to see what kinds of crimes you are sponsoring. Buying more gas from the Russians means you are giving them more capacity to escalate the war,” said Ukrainian presidential economic advisor Oleg Ustenko (Politico).

THE GEOPOLITICS: Hungary’s political relationship with Moscow and continued reliance on Russian energy has complicated the EU’s response and poses a possible threat to European unity. So far the bloc has remained impressively aligned, but there is concern going forward that continued stresses around energy availability and cost, among other things, could begin to fracture that response.

Initial Takeaways of the G7 Energy & Environment Meeting

DRIVING THE NEWS: Over the weekend, the two day G7 Ministers’ Meeting on Climate, Energy and Environment was held in Sapporo, Japan as a part of the broader G7 Summit. The meeting was focused on the global promotion of the “Green Transformation (GX)” (Japan Ministry of the Environment).

TAKEAWAYS: The participating countries and organizations focused on broad goals, including setting collective targets for massive additional deployment of 150 GW of offshore wind and 1 TW of solar by 2030 (Reuters).

While the countries agree to generally take steps toward phasing out “domestic, unabated coal power generation,” they were unable to commit to a 2030 phase out deadline that several countries–notable Canada–were pushing for. Also the use of “unabated” leaves open the option to continue using a host of coal technologies that use carbon capture and storage and other abatements approaches.

Japan also reiterated that it wants to keep transitionary LNG in the mix for at least the next 10-15 years, dampening the commitments for phasing out the fossil fuel completely in the nearer term (Japan Times).

PERSPECTIVES: Some of the notable quotes delivered by energy and trade ministers at the meeting:

“In the midst of an unprecedented energy crisis, it's important to come up with measures to tackle climate change and promote energy security at the same time," said Japanese industry minister Yasutoshi Nishimura. "We believe it is important to secure as many options as possible through utilizing such decarbonization technology as renewable energy, energy conservation, nuclear power, hydrogen, ammonia and CCUS [carbon capture, utilization and storage]." (S&P Global)

"Initially people thought that climate action and action on energy security potentially were in conflict. But discussions which we had and which are reflected in the communique are that they actually work together," said Jonathan Wilkinson, Canada's minister of natural resources.

DIVE DEEPER: Ahead of the meeting, the IEA produced a series of reports to help inform policymakers at this G7 meeting. The full list can be found here. See also a set of key excerpts from the G7 statement from Reuters.

U.S.-Japan Agreement on Geothermal Technology

DRIVING THE NEWS: On the side of the G7 meeting, U.S. Energy Secretary Jennifer Granholm and Japan’s Minister of Economy, Trade, and Industry Yasutoshi Nishimura signed a Memorandum of Commitment to cooperate on developing geothermal energy (Washington Post).

The agreement comes just weeks after the U.S. and Japan signed a similar trade agreement on critical minerals (see April 5th memo), signaling a growing bilateral clean energy relationship between the two countries.

The two countries have agreed to collaborate on R&D and to exchange information in the pursuit of geothermal projects in the U.S., Japan, and beyond. While the agreement does not specify spending amounts, it does say that each nation will fund its own associated costs.

WHY IT MATTERS: Geothermal is one of Japan’s “most plentiful” energy resources, but has yet to be developed on a large scale for power generation[2].

Lawrence Berkeley National Laboratory recently releases a report outlining a pathway for Japan to provide 90% of its power from renewable sources (reducing its GHG emissions by 92%) which includes a growing role for geothermal as a baseload provider (see The 2035 Japan Report).

Beyond growing domestic power, the U.S. and Japan will also look for ways to export geothermal technology. Japanese companies are already heavily involved in the development of the world’s largest geothermal power station under construction in Indonesia (320MW) (Asian Development Bank).

THE GEOPOLITICS: This agreements illustrates a growing trend of bilateral clean energy-based diplomacy, particularly among Western allies. For many clean technologies, the expertise, raw materials, and manufacturing supply chains are dispersed across countries, making it difficult for any one country to completely on-shore an industry. This aligns with the broader on-shoring/friend-shoring trend in which many countries are looking to consolidate supply chains among “friendly” countries.

Turkey’s Sakarya Offshore Gas Field Comes Online

DRIVING THE NEWS: Turkey is preparing to receive its first delivery from the Sakarya gas field, discovered in the Black Sea just three years ago. The country has spent billions of dollars are developing the resource, which could hold as much as 710 billion cubic meters of natural gas (Financial Times).

The resource has been developed by state oil and gas company Turkish Petroleum, along with U.S.-based Schlumberger and UK-based Seabed 7.

In its initial phase, the gas field will produce roughly 10 million cubic meters per day (equivalent to 7% of Turkey’s annual consumption), with an increase to 40 million cmd once fully operational.

Figure 2: Location of the Sakarya gas field (Source: Bloomberg)

WHY IT MATTERS: The gas field will play important roles both in near-term politics as the Turkish presidential election approaches, as well as in the longer-term future of Turkish energy and European supply.

The first deliveries from the gas field come just weeks before the highly contested May 14th presidential election. President Erdoğan faces major challenges for his handling of the economy and the recent earthquake disaster, but the timeliness of this gas delivery will allow him to make good on his promises to dramatically cut energy prices–a particularly salient issue for voters (Bloomberg).

Looking beyond politics, Turkey intends to use the gas both as a valuable domestic supply of energy (Turkey is currently highly reliant on imports) as well as for exports to energy-hungry Europe. As output grows at Sakarya, Turkey is positioned to become a key supplier for the continent in the near- and medium-term, though the exact export quantities are still unknown.

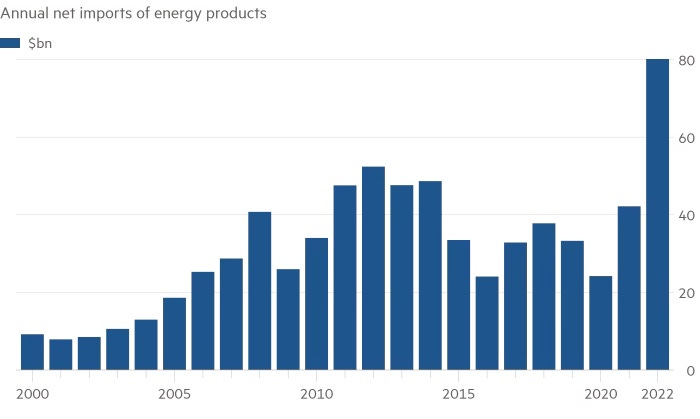

Figure 3: Turkey's energy product imports, which spiked to $80 billion in 2022 (Source: Central Bank of the Republic of Turkey and Financial Times)

[1] Noting that this action was taken as part of a pre-planned synchronization to the EU grid already underway.

[2] The Japanese spa and hot spring industry has made it difficult in the past to develop this resources for power purposes.