An AI Breakthrough That Could Upend the Energy Landscape

Plus Europe debates the future of Russian gas, why the US is seeking a deal on Ukraine critical minerals, how the energy transition connects to political backlash in Norway, and new sanctions on Iran

DeepSeek Introduces Uncertainty in the Future of AI Power Demand

DRIVING THE NEWS: Last week the AI and energy industries were thrown into chaos as DeepSeek—a China-based AI company—released its newest model, which performs on par with some of the best AI models from leaders like OpenAI but was reportedly trained on a fraction of the computing resources.

According to DeepSeek, its R1 model required less than one-tenth of the computing power needed to train Meta’s leading Llama model, primarily by improving upon the “mixture of experts” technique which allows large portions of the model’s parameters to be turned off during training (i.e., the entire model does not need to be trained simultaneously).

THE IMPACT: With electricity consumption directly related to computing power, DeepSeek’s new model calls into question the foundational assumption that power demand is set to grow rapidly with the AI boom.

Both energy and technology companies have been working to secure long-term power resources to meet the growing needs of data centers and avoid supply constraints, which have led to deals like Google, Amazon, and Microsoft signing power purchase agreements for nuclear power and a recent announcement by Chevron and Engine No. 1 to develop data center-dedicated natural gas generation. (see the Jan. 8 Global Energy Lens and Chevron announcement)

The release of DeepSeek’s new model led to upheaval in the global energy and technology markets, with major selloffs in related stocks and new questions about the long-term power purchasing strategies of tech companies. (Financial Times)

THE INTRIGUE: Despite the frantic selloff and immediate worries, however, it remains extremely unclear whether this AI breakthrough will actually lead to a substantial reduction in future power demand for two main reasons:

First, as Microsoft CEO Satya Nadella pointed out, this could be textbook example of Jevons paradox, wherein the efficiency and accessibility gains that are realized by leveraging DeepSeek’s new training approach ultimately lead to a greater increase in demand for AI, and by extension, power. (X.com)

Second, and less discussed, is that early analysis published in the MIT Technology Review suggests that the energy savings in training may actually be offset by higher energy intensity during response generation. DeepSeek’s R1 is a reasoning model, meaning it uses a “chain of thought” approach that breaks tasks into parts and works them in logical order (as opposed to generative AI, which typically generates text in a more straightforward way). Chain-of-thought models require much more energy to come to their final answers—as much as 87% more than Meta’s Llama model.

WHY IT MATTERS: While much of the commentary suggests that this is primarily a US concern in the immediate term (given the concentration of AI companies), the second-order effects on the global energy sector and the clean energy transition could be substantial.

Ultimately, any reduction in power demand would be positive for the transition to clean energy, as lower data center demand frees up renewables to actually offset fossil fuels rather than just serve new loads, and slower growth in AI power demand gives more time for deploying clean energy resources. (FT Lex)

LOOKING FORWARD: As the Technology Review put it, there have been a “dizzying number of narratives…with varying degrees of accuracy” regarding the impact this new approach to AI training will have on the energy industry. The IEA has said that DeepSeek’s model highlights the high degree of uncertainty in forecasting AI-related power demand and its broader effects on the industry.

EU Renews Russian Sanctions, Debates the Resumption of Gas Imports

DRIVING THE NEWS: The EU has renewed its sanctions on Russia for an additional six months across a broad range of sectors, but growing disagreement is emerging over whether or not to resume Russian gas imports to the bloc.

In a statement, the European Council wrote: “As long as the illegal actions by the Russian Federation continue to violate fundamental rules of international law, including, in particular, the prohibition on the use of force, it is appropriate to maintain in force all the measures imposed by the EU and to take additional measures, if necessary.”

In parallel, however, the Financial Times reported that EU officials are in heated discussion over whether to reopen Russian pipeline gas imports to Europe as part of a potential negotiated end to the conflict in Ukraine, with far right leaders in Germany (particularly Alternative for Germany, or AfD) and Hungary in strong support.

THE CONTEXT: Since the start of the Ukraine-Russia war, high energy prices have put pressure on the European industrial sector, with prices reaching 3-4x those in the US. The remaining natural gas imports from Russia were halved last month when Ukraine chose not to renew its transit agreement with Moscow.

Prior to the war, Russian natural gas imports met roughly 40% of Europe’s demand. Germany relied on Russia for as much as one third of its oil, half of its coal, and over half of its natural gas. (see Brookings' deep dive on Europe’s pre-war reliance on Russia)

THE GEOPOLITICS: In addition to reducing the price burden on European industry, some European leaders view the potential reopening of gas imports as a lever to bring Russia to the negotiating table and incentivize a long-term peace agreement.

However, the idea has already sparked backlash from EU officials, who have sought to permanently end Europe’s reliance on Russian fossil fuels by 2027 for national security reasons, as outlined in the REPowerEU Plan. In response to the reporting, European Commission Chief Spokesperson Paula Pinho stated: “We are not making any links to peace talks for the moment. The line has been set on this. Whenever we have such talks when that moment comes, it will be with Ukraine”

Beyond the energy issue, this disagreement also reflects a broader political rift unfolding between EU officials in Brussels and rising influence of populist movements in some member states, which have at times tested the bloc’s unity.

For the US LNG export industry, a resumption of Russian gas export to Europe would be highly detrimental, as pipeline gas makes LNG imports much less competitive.

WHY IT MATTERS: As discussed below, President Trump has expressed a desire in quickly resolving the war, forcing western leaders to reassess what they are willing to negotiate with Russia to end the conflict and where they draw a hard line.

Trump’s Push to Secure Ukrainian Critical Minerals

DRIVING THE NEWS: On Monday, President Trump announced that he is looking to negotiate an agreement with Ukraine that would grant the US access to the country’s critical mineral reserves in exchange for continued military and economic aid.

While criticizing the disproportionate military and economic support the US has provided Ukraine compared to its European allies, Trump said: “We’re putting in hundreds of billions of dollars. They have great rare earth. And I want security of the rare earth, and they’re willing to do it.” (AP News)

THE CONTEXT: Notably, this idea of a strategic economic partnership regarding Ukraine’s natural resources originated from Ukraine (not Trump), which included this point in its five-part Victory Plan published last fall. (Office of the President of Ukraine)

The Victory Plan was developed by Ukrainian leadership for the incoming Trump Administration in an effort to avoid any bilateral US-Russia negotiations that might exclude and threaten continued Western support.

The plan was written with input from European allies and senior US figures, including Senator Lindsey Graham (R-SC), who first proposed the idea of providing access to natural resources to Western partners. (Financial Times)

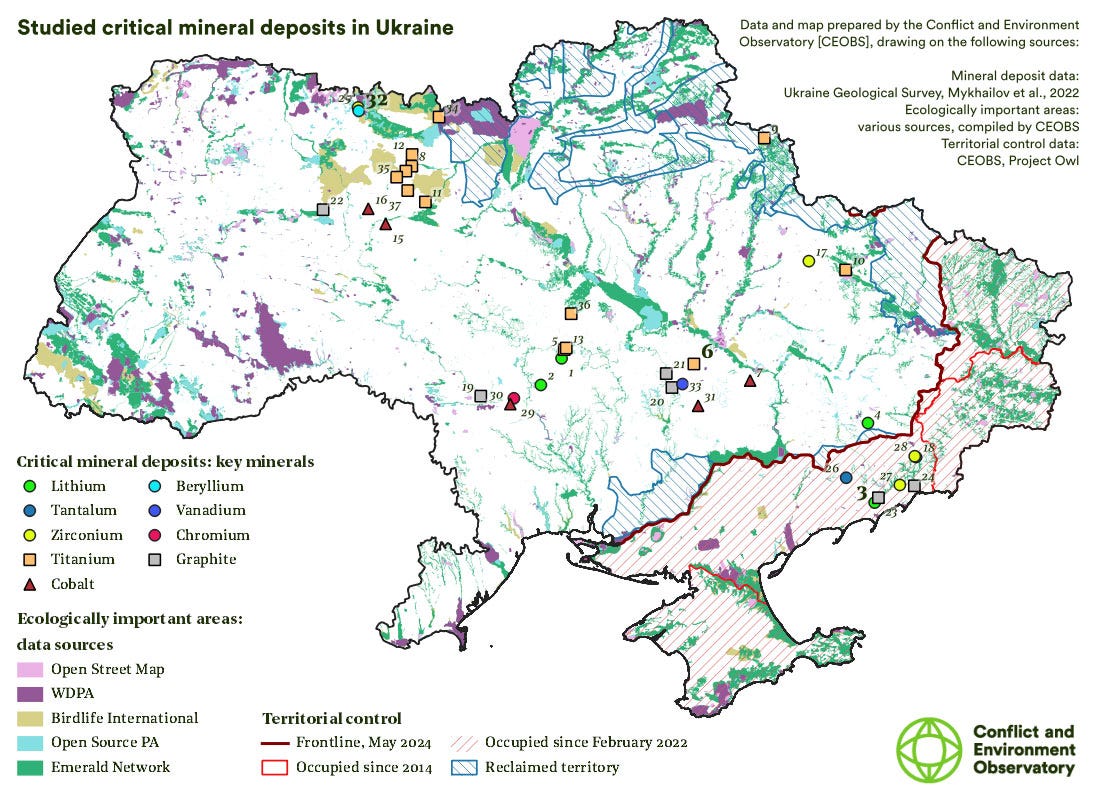

WHY IT MATTERS: Ukraine has some of the largest critical mineral deposits in Europe, including over 500,000 tonnes of identified lithium reserves, the largest titanium reserves in Europe, and a leading production capacity of gallium, as well as graphite, tantalum, zirconium, niobium and other rare earth elements (REEs). Of 37 identified critical mineral deposits, seven are currently under Russian-occupied territory. (CEOBS)

THE GEOPOLITICS: With the world’s critical mineral supply chains highly concentrated in China (particularly for processing), the US, Europe, and other partners are seeking to reduce dependence and diversify their sourcing to more politically and ideologically-aligned nations.

Given its abundant resources, Ukraine could be well positioned to become an important supplier to its allies, particularly as demand for critical minerals continues to increase to meet the needs of the semiconductor, clean energy, and defense industries.

In the long term, securing a role as a key supplier would strategically benefit Ukraine, as Western partners would have a stronger incentive to ensure its security against future Russian incursions.

WHAT’S NEXT: In response to Trump’s comments, Russia has angrily denounced the proposal as a commercial agreement for aid that will prolong the conflict (that it began), while German Chancellor Olaf Scholtz called it, “very egotistic, very self-centered”, noting that Ukraine will need the resources to help fund its post-war recovery. It remains to be seen how such an agreement might unfold. (Politico.eu)

DIVE DEEPER: Both the NATO Energy Security Center of Excellence and the Conflict and Environment Observatory published analysis on Ukraine’s critical mineral resources in the context of Russia’s invasion. For a full overview of the Victory Plan, see Ukraine’s official website.

Norway’s Political Fallout Tied to EU Energy Policies

DRIVING THE NEWS: Norway’s governing coalition has collapsed over a disagreement on the adoption of EU energy policies, leaving the center-left Labour Party without a majority government until at least elections in September. (Reuters)

THE CONTEXT: While not a part of the EU, Norway has traditionally sought to strengthen its relationship with the bloc by adopting EU regulations in order to keep its industry competitive in the European market.

With the looming threat of a trade war between the US and EU, Norway has been working to deepen ties even further. However, several prominent voices—including the euroskeptic Centre Party—have raised concern over this approach, given that Norway has no official input in the EU regulations themselves.

"We think it's wrong to hand over more power to the EU, and that we should instead go in the opposite direction," said Finance Minister Trygve Slagsvold Vedum of the Centre Party, which withdrew from Prime Minister Jonas Gahr Støere’s majority coalition.

WHY IT MATTERS: The coalition collapse highlights the inherent tension between economic interdependence and national sovereignty. Two-thirds of Norway’s exports go to the EU, yet Norway has no official say in Brussels’ decisions. This also underscores the challenges posed by an interconnected energy transition.

Norway is a heavily electrified economy (due to a high penetration of electric vehicles and heat pumps), which means that power prices have a major impact on both the economy and daily life.

While Norway is typically a major exporter of electricity given its large hydropower resources, excessive exports to help its neighbors meet supply gaps can result in increases to domestic prices. As I wrote about last month, these price spikes can fuel public anger and the type of political backlash now on display.

ENERGY TRANSITION: As Europe continues to transition its energy system away from Russian fossil fuels and toward cleaner energy resources, increased power system integration across the bloc and with neighbors like Norway is likely to increase. This situation underscores the need to proactively manage the trade-offs of a more interconnected grid, ensuring economic and political stability alongside the energy transition.

WHAT’S NEXT: The energy policies in question—which involve renewable energy requirements, building energy performance, and energy efficiency—are mandatory for Norway as a member of the European Economic Area. (Euractiv) Prime Minister Jonas Gahr Støere will need to navigate their implementation while continuing to govern as a leader of a minority government.

Re-establishing Maximum Sanctions on Iranian Oil

DRIVING THE NEWS: President Trump this week signed a new memorandum resuming the “maximum pressure” campaign on Iran aimed at stopping the country’s pursuit of a nuclear weapon. (The White House)

Central to the policy is a directive to the US Treasury and State Departments to reduce Iran’s oil exports to zero.

THE CONTEXT: While Iranian oil has been under US sanctions for years, exports began to rise again under the Biden Administration as Iran became more sophisticated at sanctions evasion and China declined to recognize the US restrictions.

China is the largest importer of Iranian crude oil, and has set up a system based almost entirely on the Chinese yuan to avoid exposure to US dollar-based restrictions. (Reuters and Statista)

WHY IT MATTERS: Iran has increased its uranium enrichment activities according to the international nuclear watchdog agency International Atomic Energy Agency (IAEA), and worries are mounting that recent defeats for Iran (including the weakening of Hamas and Hezbollah by Israel and the overthrow of Iran-backed Bashar al-Assad in Syria) may increase its determination to develop a nuclear weapon. (S&P Global)

THE GEOPOLITICS: In addition to unilateral sanctions, the US is also reaching out to allies including the UK, France, and Germany to enforce the “snapback” of international sanctions, a system that was originally put in place under the 2015 Iran Nuclear Agreement (JCPOA), which the US exited in 2018 during Trump’s first term.

The US has also introduced a new tool under the 2024 Stop Harboring Iranian Petroleum (SHIP) law, which allows the administration to expand sanctions further up the value chain on financial institutions, oil terminals and operators, and refineries. (Windward)

The sanctions could remove up to 1 million barrels per day of Iran exports from the market. While the IEA believes Saudi Arabia, the UAE, and other OPEC members have the spare capacity to fill the gap, prices could increase from $72 per barrel back up to $90 without Iranian supply.

WHAT’S NEXT: This sets up a potential tension between Trump's hardline stance on Iran and his political need to keep domestic fuel prices low—a factor that could influence both the scope of sanctions enforcement and the likelihood of a negotiated deal

DIVE DEEPER: In December, the UN nuclear agency IAEA spoke with Reuters at length about Iran’s accelerating nuclear program.