EU Embraces Tech-Neutral Climate Policy

Plus the U.S. sees growing investment in its "battery belt", Iraq wins a major court battle over oil exports, and North Africa is looking to expand O&G to serve growing demand

Satellite image of Turkey’s Ceyhan port, which exports roughly 1% of global supplies per day. Much of that came from the Kurdistan Regional Government until this week. (Source: CNBC/Getty Images)

This week the EU came to an agreement with Germany to use a technology-neutral approach to their vehicle emission legislation, part of a wider policy trend of focusing on the carbon intensity of technologies rather than prescriptively technology mandates. The U.S. saw yet another very large foreign investment into a battery facility which will contribute to the growing U.S. “battery belt”, and House Republicans shared their domestic energy priorities through their Low Energy Cost Act. And in MENA, Iraq won a major oil export case against Turkey and the Kurdistan Regional Government, and O&G development in North Africa is beginning to pick up pace.

EU Decision Furthers Shift to Technology-Neutral Decarb Policies

DRIVING THE NEWS: German and European Union negotiators have reached an agreement that will allow the EU’s 2035 ban on new combustion engine vehicle sales to move forward with an exception for entirely carbon-neutral synthetic fuels (“e-fuels”).

Germany has been pushing to allow the sale of new combustion vehicles beyond the proposed 2035 ban, which has threatened the ability of the EU to pass this policy central to its 2050 carbon neutral goal (NY Times). Following the agreement, EU energy ministers are meeting in Brussels this week for a vote.

“The way is clear: Europe remains technology-neutral. Vehicles with combustion engines can also be newly registered after 2035 if they only use CO2-neutral fuel. We secure opportunities for Europe by retaining important options for climate-neutral and affordable mobility,” Tweeted Volker Wissing, Germany’s Transportation Minister (Electrek).

THE WIDER TREND: Beyond allowing the EU to move forward with its 2035 ban, particularly striking with this agreement is the turn toward a technology-neutral rather than technology-prescriptive approach. This mirrors a wider trend in the decarbonization policymaking space.

Technology-neutral qualification is playing a big role in the U.S.’s Inflation Reduction Act, which uses carbon-intensity (or “emissions-based”) qualifiers for subsidies for clean electricity and hydrogen credits. Instead of dictating the type of technology (e.g. solar, wind, biomass) or the source “color” of hydrogen[1], subsidies instead are based on the emissions per kWh or kgH2 produced.

On one hand this paradigm shift opens up a wider range of possible technological solutions for decarbonization, which can be great for maximizing new technology uptake and reduction in emissions. However, it also means that there is more at stake when it comes to the specifics of how various technologies and processes are classified as “carbon-free” or similar, including what role that offsets play.

This has important implications on the energy sector: it can help catalyze new technology R&D, but also opens potential options for existing producers to claim “decarbonization” of primary energy sources such as oil and gas through creative accounting and purchasing of offsets, which has questionable impact on actually reducing emissions.

LG Energy Solution to Invest $5.5 billion in Arizona Facility

DRIVING THE NEWS: South Korean manufacturer LG Energy Solutions (LGES)–one of the world’s largest battery manufacturers–announced a 4x increase in their investment to $5.5 billion for a new EV battery and energy storage system manufacturing facility.

The factory will produce roughly 27 GWh of EV batteries starting as soon as 2025 and 16 GWh of lithium iron phosphate (LFP) energy storage systems beginning in 2026. EV battery customers will include General Motors, Ford, Honda, and Tesla (NY Times).

The announcement was celebrated by elected officials from Arizona, including Governor Katie Hobbs and Senator Mark Kelly who shared that, “Thanks to unprecedented federal investments in American-made clean energy manufacturing, Arizonans will see stronger supply chains, lower costs, and a more competitive economy for the generations to come” (AZ Commerce Authority).

WHY IT MATTERS: LGES cited the Inflation Reduction Act as one of the key driving forces of their investment decision. As more clean tech manufacturing investment pours into the U.S., companies have been very vocal about the role the IRA is playing in their decisions. This is important to help continue advancing political support on both sides of the aisle for the law.

A press release from LGES explains: “The company’s decision to increase investment in cylindrical EV battery production in North America comes from rising demand from EV makers for locally manufactured high-quality, high-performance batteries in an effort to satisfy the Inflation Reduction Act (IRA)’s EV tax credits.”

THE WIDER TREND: Investment in U.S. battery manufacturing facilities has been growing at an unprecedented rate, as outlined back in the Feb. 15th newsletter. These investments to serve the growing demand for EVs and grid storage are being dubbed the U.S. “battery belt”, as visualized by Argonne National Laboratory below:

Planned battery manufacturing capacities in North America by 2030 (Source: Argonne National Lab and Renewable Energy World)

DIVE DEEPER: Li-Bridge–a public-private alliance focused on accelerating the development of a U.S. domestic lithium-based battery supply–recently published an in-depth report on growing and strengthening the U.S. lithium battery supply chain: Building a Robust and Resilient U.S. Lithium Battery Supply Chain.

Oil Development in North Africa

DRIVING THE NEWS: Major O&G developers including Halliburton, Honeywell, Chevron, and Eni are reportedly ramping up their presence in North Africa as political risk lessens and demand from Europe continues to grow (Wall Street Journal).

Halliburton and Honeywell exploring investment of $1.4 billion to develop an oil field and refining capacity in Libya with the state-owned National Oil Corporation, which manages the largest known oil reserves in Africa (according to the firm’s chairman).

The NOC will seek to increase oil production from 1.2 mn bpd today to 2 mn bpd and gas production from 2.6 bn cfd to 4 bn cfd in the next 3-5 years.

Eni is working with Algeria toward the goal of replacing half of the gas volume that Italy used to import from Russia–roughly 3 billion cubic meters per year– with Algerian supply. “Algeria is a reliable partner of absolute strategic importance,” said Italian PM Giorgia Meloni.

WHY IT MATTERS: Europe’s increased demand for oil and gas since turning away from Russia is providing a window for suppliers to explore and develop new sources in places like North Africa that were previously too risky or too expensive.

North Africa in general has become more politically stable. In Libya, domestic conflict between local militias has eased over the last two years. However, the country is still politically divided, with a UN-appointed prime minister Abdul Hamid Dbeibeh in Tripoli and a rival PM in the east (more details on Libya from Financial Times). The country is currently pushing to hold presidential and legislative elections later this year and Sec. Blinken told a senate committee last week that the US is working to reopen an embassy in Libya after closing it in 2014 due to violent clashed between militias (Reuters).

“North Africa has been slow to develop its potential because of political risks, either related to insecurity or bureaucracy,” said Geoff Porter, President of US-based North Africa Risk Consulting Inc. But he noted that “this is their moment”.

International Court Rules in Favor of Iraq to Halt Kurdistan Oil Exports to Turkey

WHY IT MATTERS: The ruling has major impacts on Turkey, which will now need to source more oil from Iran and Russia to make up the shortfall. It also puts extreme pressure on the Kurdistan economy and the Kurdistan Regional Government (KRG), which depends on oil exports for revenue and financial independence from Baghdad, and may now be at risk of financial collapse.

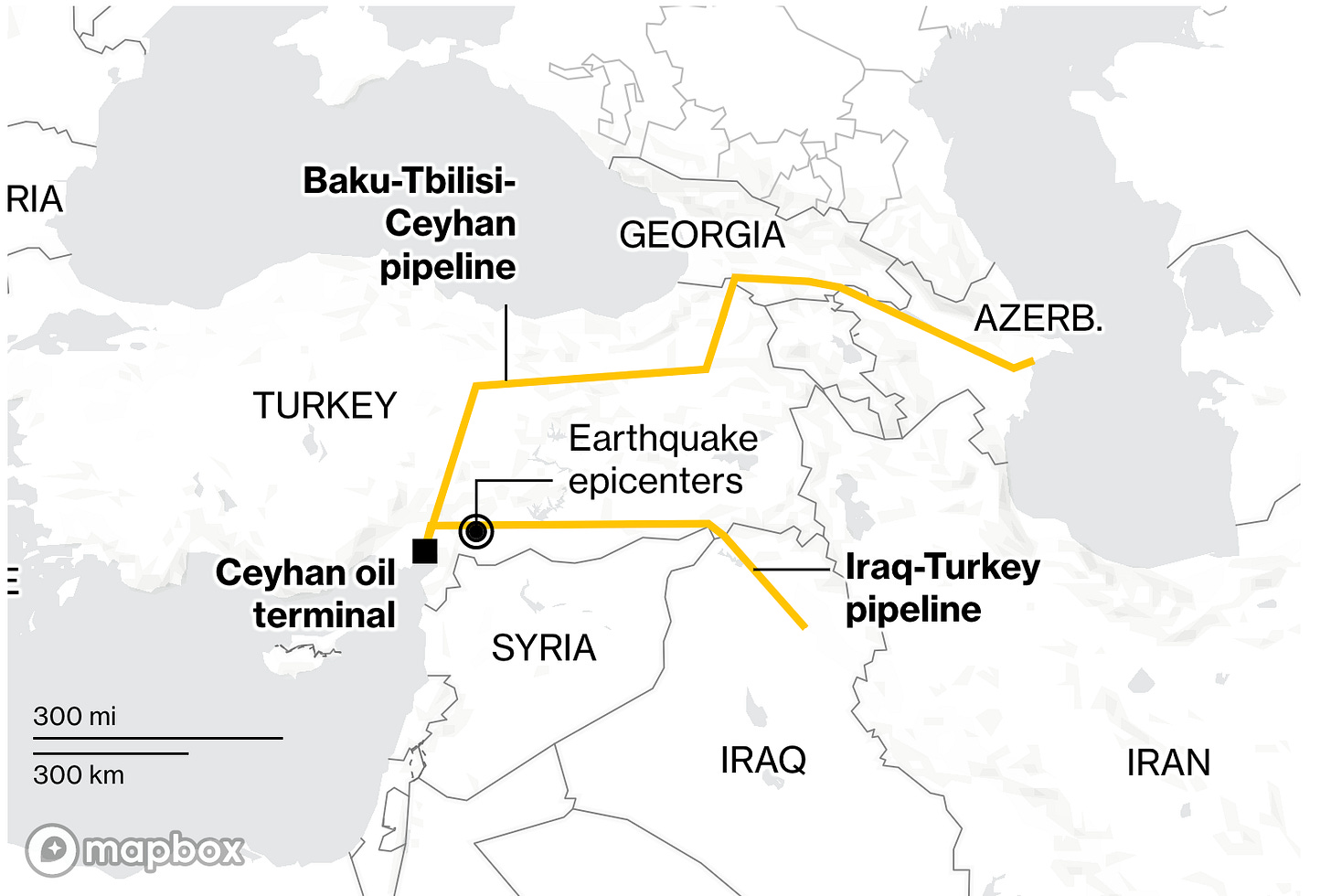

Turkey’s Ceyhan port receives roughly 1 million barrels per day via the Iraq-Turkey and Baku-Tbilisi Ceyhan pipelines for use and export, equivalent to about 1% of global supplies (Bloomberg). Of that, 75,000 bpd is sent by Baghdad and 370,000-400,000 bpd from the KRG.

Map of the two key pipelines serving the Ceyhan port in Turkey (Source: Bloomberg)

DRIVING THE NEWS: Last week Iraq won a long-running case against Turkey to halt oil exports from the semi-autonomous Kurdistan region to Turkey’s Ceyhan port and to recover $1.5 billion from “illegal” exports.

The decision was made by the International Chamber of Commerce’s International Court of Arbitration, which has been involved with the case since 2014 when Baghdad first filed the complaint (Reuters).

Following the ruling, Turkey will commit to no longer importing crude oil from of Kurdistan without the consent of Iraq’s federal government (Bloomberg).

THE CONTEXT: Iraq has been claiming that Turkey’s importing of Kurdish oil without the Baghdad’s approval is in violation of a 1973 pipeline agreement between the two countries.

In 2022 an Iraq supreme court ruled the Iraqi Kurdistan energy industry unconstitutional (S&P Global), yet the region has continued to exploit what it considered ambiguity in Iraq’s constitution to continue exporting.

GOING FORWARD: Following the ruling, Iraq’s oil ministry said that it will discuss “mechanisms for exporting Iraqi oil through [Turkey’s] Ceyhan port with the concerned authorities in the Kurdistan region as well as with the Turkish authorities” (Financial Times). The ministry also announced that, “a delegation from the oil ministry will travel to Turkey soon to meet energy officials to agree on new mechanism to export Iraq's northern crude oil in line with the arbitration ruling.”

The KRG Ministry of Natural Resources also issue a statement saying: “arbitration ruling in favor of Iraq against Turkey will not impede the relations with Baghdad's government and dialogue to continue” (Reuters).

House Republicans to Vote On Low Energy Costs Act

DRIVING THE NEWS: This week House Republicans will vote on their domestic energy bill titled the Low Energy Costs Act (H.R.1), designed as a response to the Democrat’s Inflation Reduction Act passed last year.

The bill was introduced earlier this month by House Majority Leader Steve Scalise (R-LA) and is likely to passed in the House this week. Senate Majority Leader Chuck Schumer (D-NY), however, has been clear that the bill will be “dead on arrival” in the Senate, providing no option for the law to move forward in its current form (E&E News).

This week the CBO released its official report on the bill, which it finds will increase the federal deficit by $2.3 trillion by 2033. The increase is largely due to the revenue-sharing mandates, halting of the methane fee, and changes in royalty fees.

WHY IT MATTERS: While this particular law will not get past the Democrat-controlled Senate, it does provide a window into what energy issues are of top priority to the Republican party at this moment.

KEY COMPONENTS: Overall, the Low Energy Costs Act focused on reducing permitting hurdles for all types of energy infrastructure, increasing supplies of critical materials and exports of natural gas, and stopping the more regulatory components of the IRA (Wall Street Journal).

Permitting: The bill would mandate a one-year time limit for determining environmental impact and a two-year limit for more extensive impact reports. It also proposes making lawsuits against projects more difficult by requiring potential plaintiffs to submit comments during the public comment period, restrict lawsuits to only the topics listed in comment, and file any legal action within 120 days after completion of the review.

LNG Exports: The bill would give FERC exclusive authority to approve or deny applications for new natural gas export and import infrastructure, including LNG terminals[2].

Critical Minerals: H.R.1 promotes the production of critical minerals–particularly for EV batteries–by allowing the DOE to grant up to 50 year easements for extraction and reducing federal fees on sales.

Repealing IRA Clauses: The bill proposes a repeal of the methane emissions fee put in place through the IRA which will institute a fee of $900 per metric ton starting in 2024 and increase to $1,500 starting in 2026. It also seeks to cancel the $27 billion green bank program.

DIVE DEEPER: The full H.R.1 bill can be read on Congress.gov, and quotes from high ranking Republicans supporting the bill can be found on the House Energy & Commerce website. Congressman Scalise also provided a useful summary of all the H.R.1 provisions.

[1] In recent years hydrogen production has been described using a series of colors, including green for renewable-power electrolyzers, blue for natural gas, and yellow for electrolysis from solar cells. More information on the hydrogen rainbow from Popular Science.

[2] This mirrors a 2015 repeal of the U.S. crude oil export ban, which led to a major increase in export volume and solidified the U.S.’s role as a global energy supplier but created mixed impacts on the industry at large according to the GAO.